URD 2022

-

1. PRESENTATION OF THE COFACE GROUP

1.1History of the Group

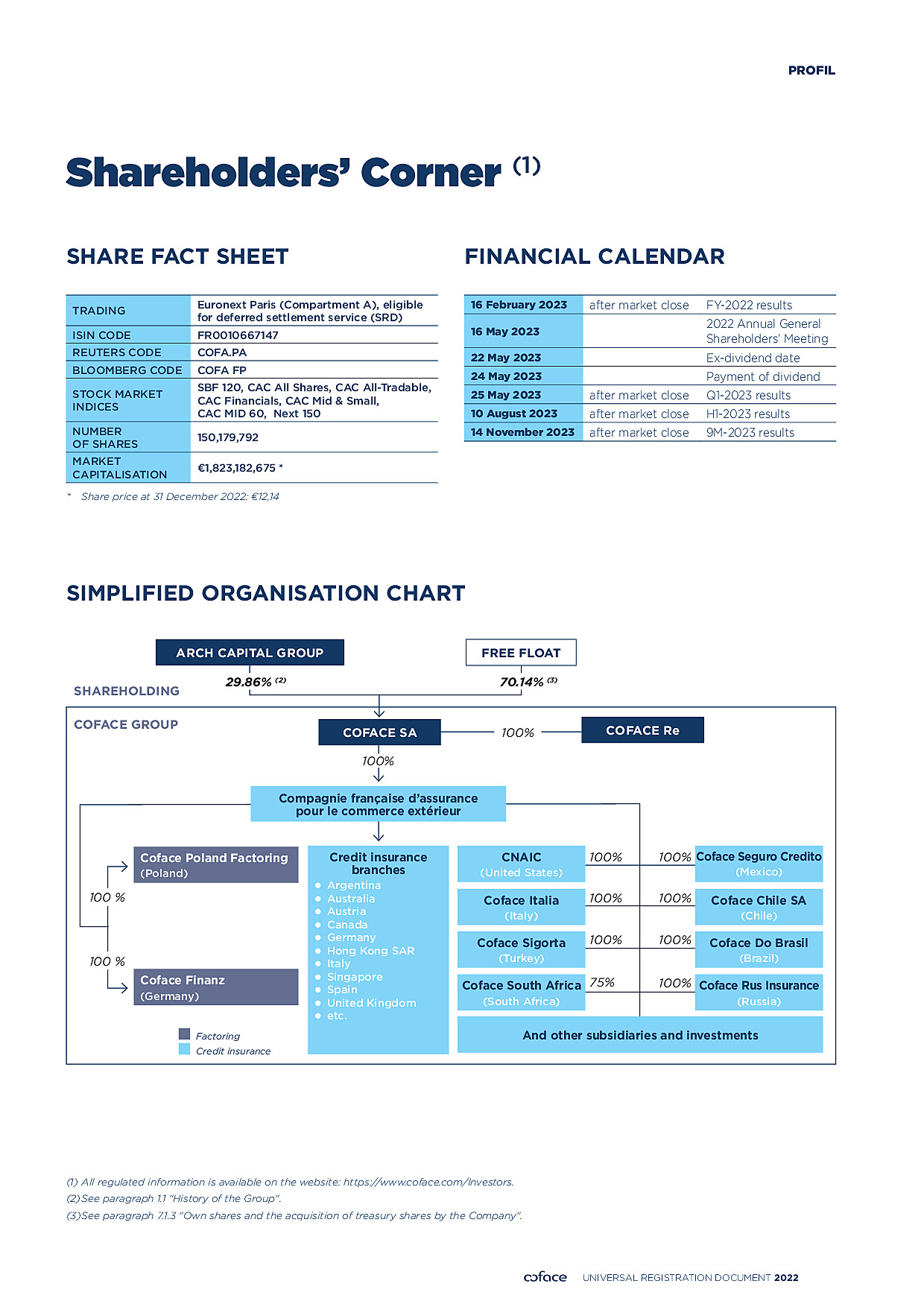

COFACE SA (“the Company”) is the holding company of the Coface Group (“the Group”). It performs its activities through its primary operating subsidiary, Compagnie française d’assurance pour le commerce extérieur, and its subsidiaries. The key dates in its history are described below.

1.1.1Creation and changes to shareholding structure

Compagnie française d’assurance pour le commerce extérieur was created by decree in 1946 and established in 1948 to support French foreign trade. It is the source of the Group as it exists today. Its first shareholders – insurance companies, banks and other financial establishments – were primarily controlled by the French State. Following the privatisation of a large number of these companies in the 1980s, the French government’s indirect holdings gradually decreased.

With the privatisation of SCOR (a result of the privatisation of UAP), its major shareholder, most of the capital of Compagnie française d’assurance pour le commerce extérieur became private, but Coface continued to manage State guarantees on behalf of the French State.

Compagnie française d’assurance pour le commerce extérieur was listed on the primary market of the Paris Stock Exchange by its shareholders.

Natexis Banques Populaires, established through the acquisition by the Caisse centrale des banques populaires of Natexis, which resulted from the merger of the Group’s two original shareholders (Banque française du commerce extérieur and Crédit national), acquired 35.26% of the Compagnie française d’assurance pour le commerce extérieur share capital from SCOR and became its majority shareholder, owning 54.4% of the share capital.

After Compagnie française d’assurance pour le commerce extérieur was delisted from the Paris Stock Exchange in 2004, it became a wholly owned subsidiary of Natixis, the entity born out of the merger between Natexis Banques Populaires and Ixis CIB. Natixis is the financing, asset management and financial services bank of Groupe BPCE, one of the leading French banking groups, which was created by the merger of the Banques Populaires and Caisses d’Epargne in 2009.

The Company strengthened its equity through two capital increases, fully subscribed by Natixis, for €50 million and €175 million respectively, in view of maintaining the Group’s solvency margin in the sharp economic slowdown at that time.

On June 27, the Company launched an initial public offering (IPO) on Compartment A of the Euronext Paris regulated market. The offering concerned a total of 91,987,426 shares, representing 58.65% of its capital and voting rights.

The Company proceeded with two share buyback programmes, of €30 million and €15 million respectively, under the second pillar of the Fit to Win strategic plan, with the aim of improving the capital efficiency of its business model.

On June 24, the Euronext Expert Indices Committee included COFACE SA in the SBF120, the flagship index of the Paris Stock Exchange. This was thanks to the improved liquidity of Coface securities and an increase in its market capitalisation.

On February 25, Natixis announced the sale of 29.5% of the capital of COFACE SA to Arch Capital Group Ltd (“Arch”). Completion of the transaction was subject to obtaining all the required regulatory authorisations. At December 31, Natixis’ stake in the Company’s capital remained at 42.20% pending the completion of the transaction.

On October 26, the company launched a €15 million share buyback programme. Through the Build to Lead strategic plan, Coface continues to improve the capital efficiency of its business model.

On February 10, Natixis and Arch Capital Group announced that the sale of 29.5% of COFACE SA’s shares had obtained all the necessary approvals. Following this transaction, Natixis’ stake in the Company’s capital stood at 12.7%.

On January 6, Natixis announced the sale of its remaining stake in COFACE SA. This disposal represented approximately 10.04% of COFACE SA’s share capital, or 15,078,095 shares. It was carried out by means of an accelerated bookbuild (ABB) at an average price of €11.55. As a result of this transaction, Natixis no longer holds any shares in COFACE SA.

-

1.2Presentation of the credit insurance market and the competitive environment

1.2.1Credit insurance market

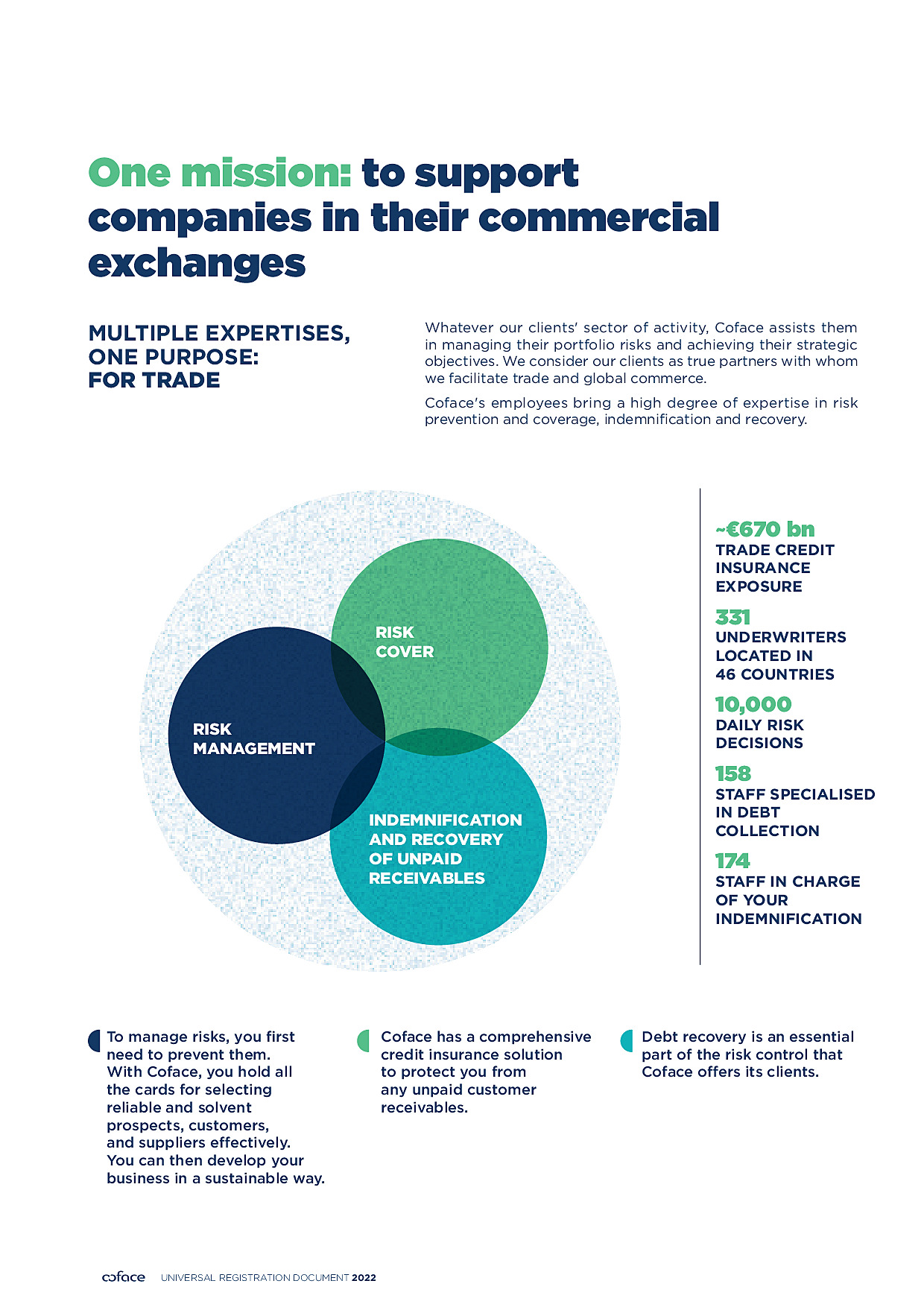

The purpose of credit insurance is to protect a company against default on the payment of its trade receivables. It provides conditional insurance coverage on counterparties approved by the insurer. The solution offers two basic services: the prevention of debtor risks – by selecting and monitoring insured buyers – and the collection of unpaid receivables. In the classic form of the product, these two services are the main hallmarks of the expertise of sector players.

The Group’s principal activity concerns short term credit insurance (defined by risks of no more than 12 months), which is a market representing around €8 billion in premiums. The Group is also active in the medium term credit insurance market through its Single Risk offer. This is a global market which is often syndicated, with a value of some €1.8 billion of premiums. In 2022, the Single Risk business accounted for approximately 1.4% of the Group’s consolidated turnover.

The Group believes that the credit insurance sector has significant growth potential. The credit insurance penetration rate in the total volume of trade receivables worldwide remains very low, estimated at between 5% and 7%, which means that there is a genuine opportunity for conquering new markets. However, growth in the sector remains modest, at around 3%, and typically fluctuates between 0% (2016) and 5% (2005-2009, 2019) when driven by the global economy (1). In 2020, however, the market contracted by more than 5% due to the economic crisis caused by Covid-19, which has given way to a strong recovery since 2021, strengthened by the effects of inflation in 2022.

-

1.3Principal activities

The Group’s activities are mainly focused on credit insurance, which represented 89.8% of turnover in 2022. This entails providing businesses with solutions to protect them against the risk of client debtor insolvency in both their domestic and export markets.

The Group is also present in the factoring market, in Germany and in Poland, and in the surety bond market. In some countries, mainly in Central Europe and Israel, the Group has historically sold business information and debt collection products. In 2020, the Group decided to modernise its information offering to develop new markets. The new ICON sales portal has been launched and the activity has entered the acceleration phase, in line with the Group’s strategic plan.

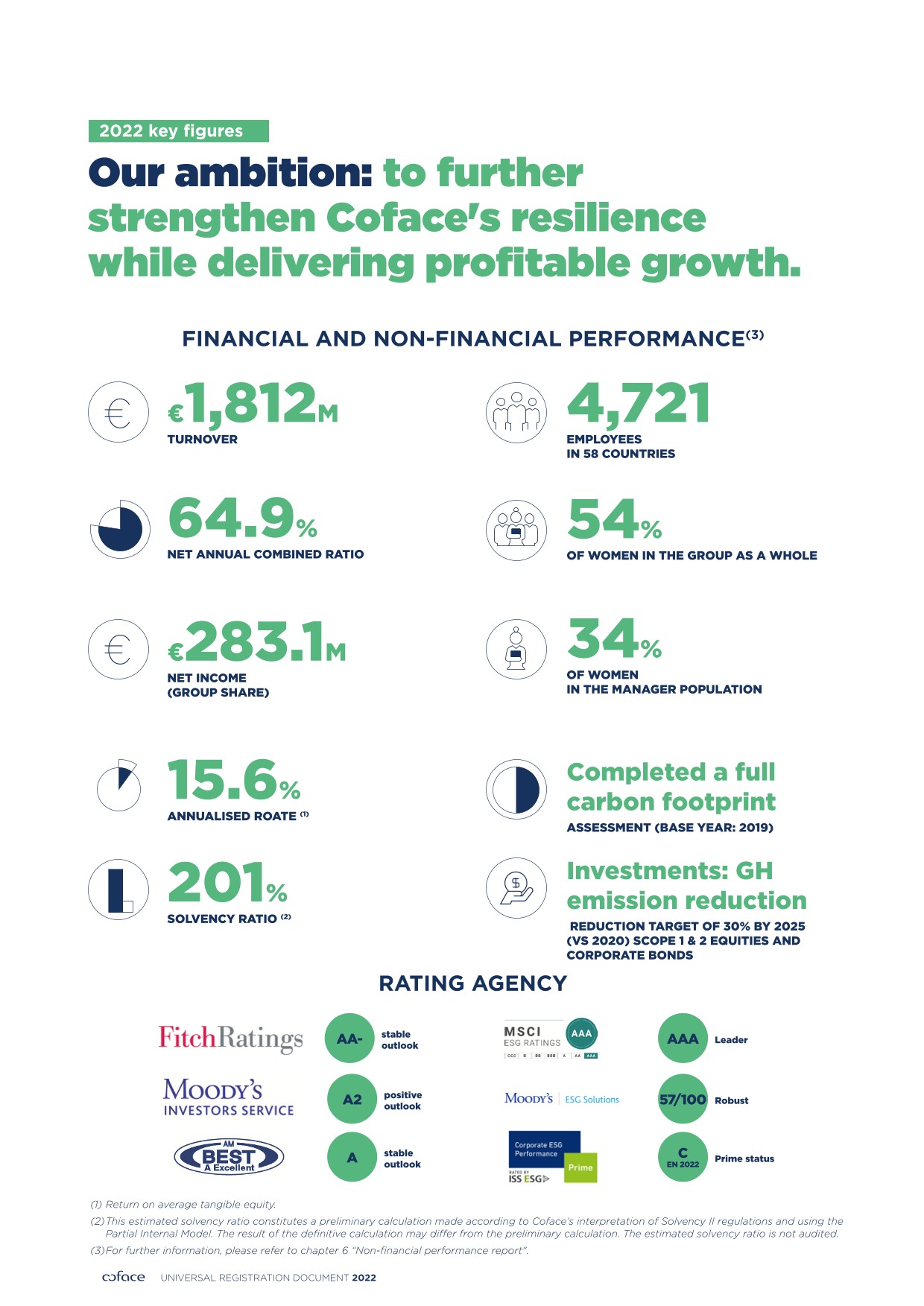

The Group generates its consolidated turnover of €1,812 million from approximately 100,000 (1) clients. Average annual income per client is less than €30,000 and is generated in very diversified business sectors and geographic regions.

The Group considers that it is not dependent on any individual policyholders. For the financial year ended December 31, 2022, the largest policyholder accounted for less than 1.2% of its consolidated turnover.

The following table shows the contribution of these activities to the Group’s consolidated turnover at December 31 for the 2020-2022 period:

/Consolidated turnover by business line

(in thousands of euros and as a % of the Group total)

See also Section

Dec. 31, 2022

Dec. 31, 2021

Dec. 31, 2020

(in thousands of euros)

(as a %)

(in thousands of euros)

(as a %)

(in thousands of euros)

(as a %)

Gross earned premiums – Credit

1,444,175

79.7%

1,242,767

79.3%

1,132,876

78.1%

Gross earned premiums – Single Risk

24,480

1.4%

15,839

1.0%

21,141

1.5%

Gross earned premiums – Credit insurance

1,468,655

81.1%

1,258,606

80.3%

1,154,017

79.5%

Fee and commission income (1)

158,582

8.8%

140,691

9.9%

143,985

9.9%

Other related benefits and services (2)

39

0.0%

156

0.0%

102

0.0%

Turnover from credit insurance

1.3.1

1,627,276

89.8%

1,399,453

89.3%

1,298,104

89.5%

Gross earned premiums – Surety bonds

1.3.3

58,809

3.2%

54,031

3.4%

50,317

3.5%

Financing fees

32,769

1.8%

26,409

1.7%

26,995

1.9%

Factoring fees

41,126

2.3%

39,712

2.5%

32,758

2.3%

Other

(3,601)

(0.2%)

(1,720)

(0.1%)

(1,302)

(0.1%)

Net income from banking activities (factoring)

1.3.2

70,295

3.9%

64,400

4.1%

58,450

4.0%

Business information and other services

49,269

2.7%

42,266

2.7%

34,523

2.4%

Receivables management

6,202

0.3%

7,708

0.5%

9,469

0.7%

Turnover from information and other services

1.3.4

55,471

3.1%

49,974

3.2%

43,992

3.0%

Consolidated turnover

Note 22

1,811,851

100.0%

1,567,858

100.0%

1,450,864

100.0%

- Policy management costs.

- IPP commission – International policies commission; business contributors’ commission.

-

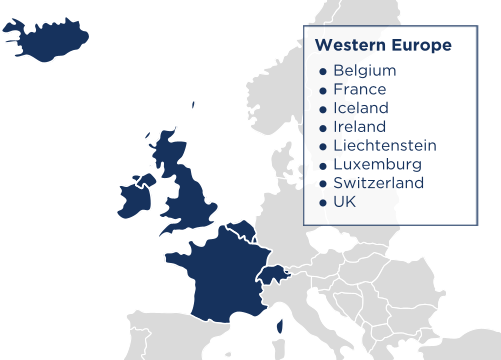

1.4Positioning of the Coface Group region by region

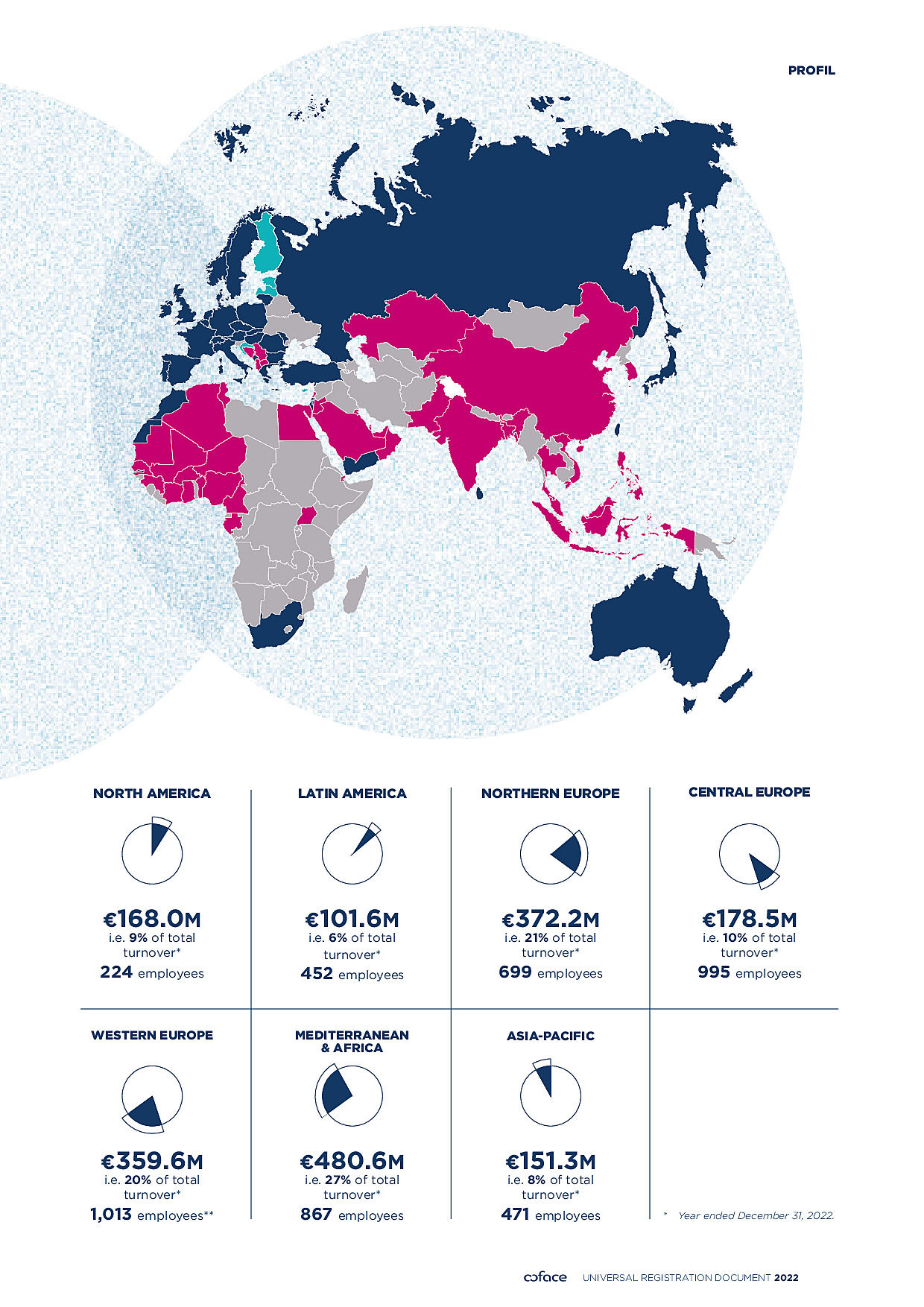

Thanks to its leading international presence, the Group organises its business lines around seven geographic regions in which it sells its products:

- ●Western Europe,

- ●Northern Europe,

- ●Central Europe,

- ●Mediterranean & Africa,

- ●North America,

- ●Latin America

- ●Asia-Pacific

Group activities in the Western Europe region

/Availability of the Group’s offering

Key figures

The Group, which currently employs approximately 1,013 people in the Western Europe region, generated turnover of €359.6 million in this region, accounting for 19.8% of its total turnover for the financial year ended December 31, 2022.

Classification of countries and offering

The Group’s activities in Western Europe are heavily oriented towards the sale of credit insurance policies. However, there are also certain local features, for example in France, where the Group also sells surety bonds and Single Risk policies. All countries in this region have significantly strengthened their information offering in line with the Build to Lead strategic plan.

Western European countries are mature credit insurance markets. The offering is mainly distributed via specialised credit insurance brokers. Large brokers use their own international distribution network or third-party distribution partners, particularly for international programmes. In France, Coface rounds out its distribution network with direct sales teams across France and is diversifying its multi-channel sales approach by developing partnerships with banks.

Marketing and strategy

-

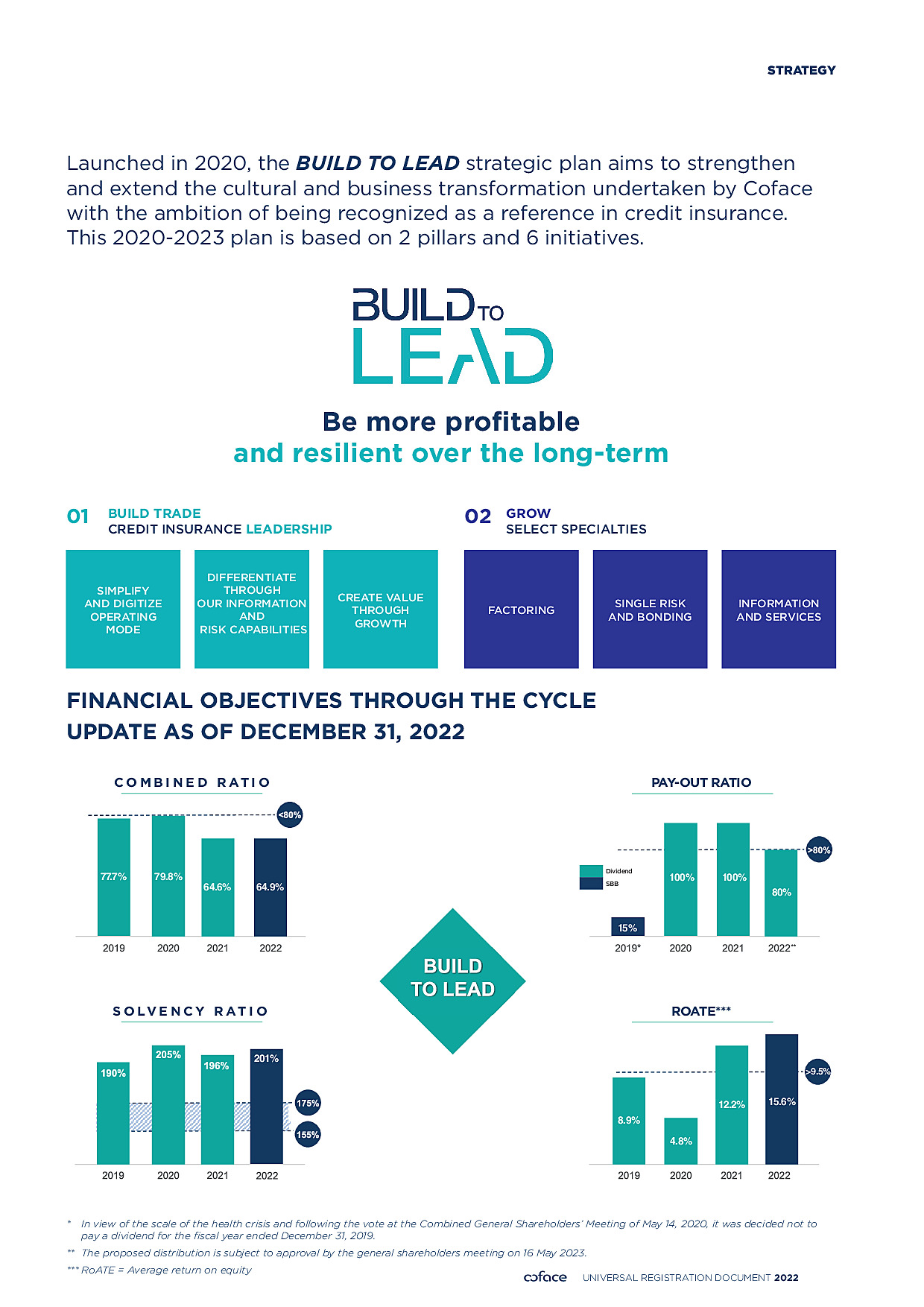

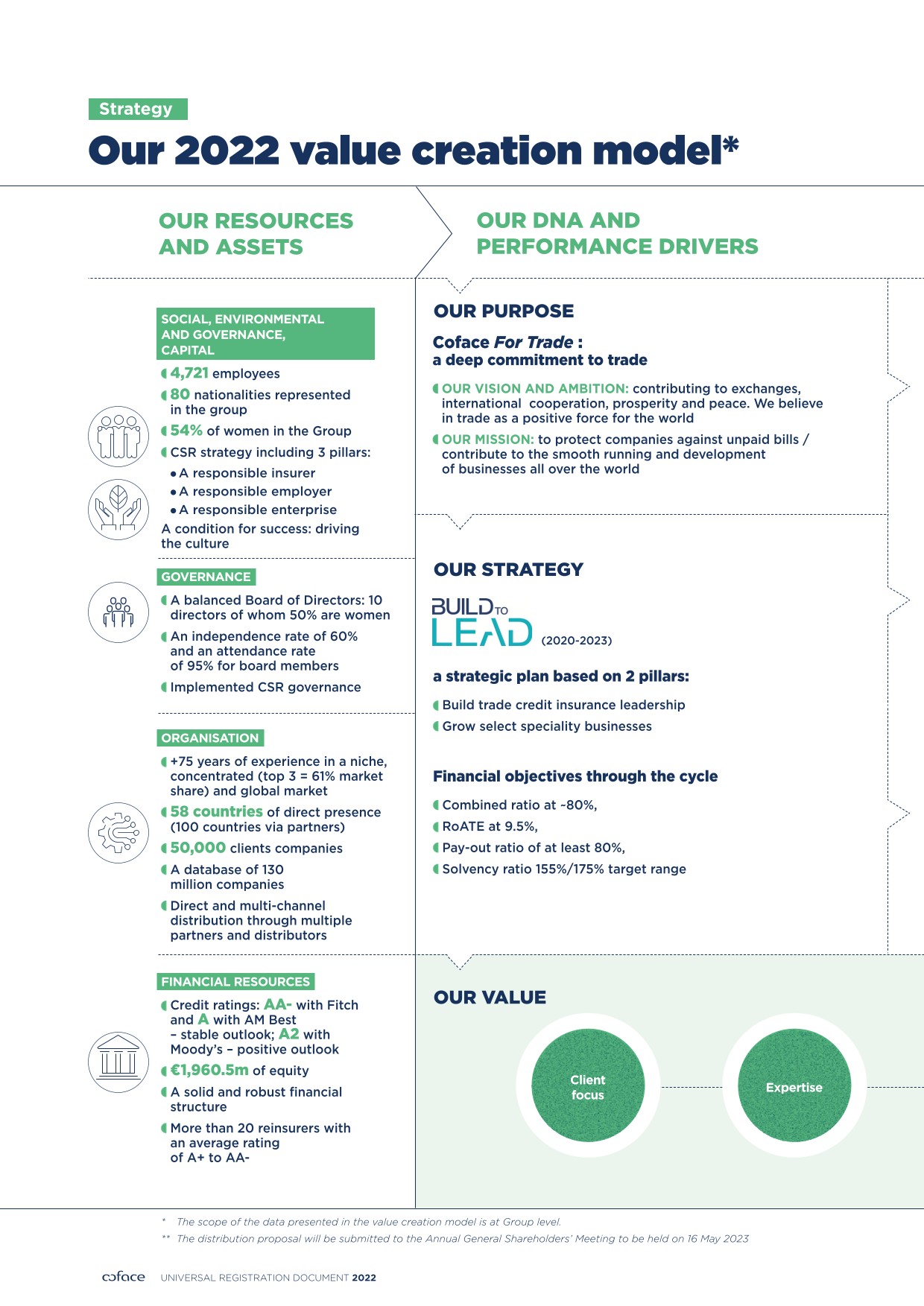

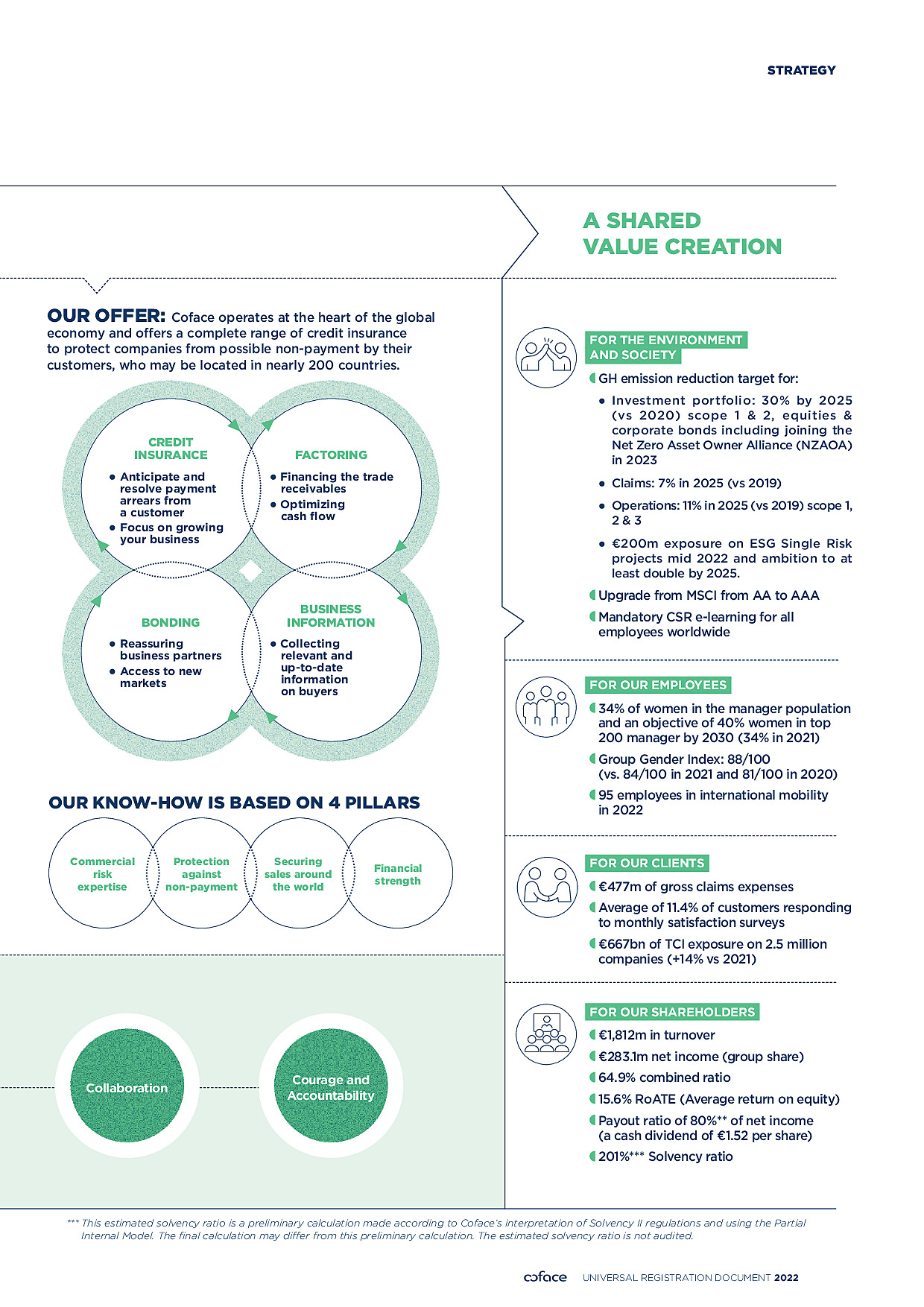

1.5Group strategy

The Build to Lead – 2023 strategic plan launched in 2020 consolidated the successes of the Fit to Win plan by reinforcing Coface’s expertise, synergies and agility. It aims to assert Coface’s leadership in credit insurance by placing the client at the centre of the Coface strategy, while creating growth opportunities in adjacent activities offering significant synergies.

The Covid-19 health crisis and the resulting economic disruption confirm the importance of the ambitions of resilience, responsiveness in client service, and agility that are set out in the Build to Lead plan. These ambitions are upheld, while the priorities have been adjusted to take account of changes in the economic environment.

1.5.1Ambitions and objectives of the Build to Lead strategic plan

The Build to Lead strategic plan aims to create the conditions for profitable and resilient long term growth for Coface. To do this, it relies on two guiding principles:

- ●strengthening the Group’s leadership in the credit insurance market by placing its clients and partners at the heart of its strategy; and

- ●creating growth opportunities, in particular by developing adjacent activities that complement Coface’s long-standing credit insurance business, for example information services, surety bonds, Single Risk coverage and factoring;

-

1.6Group organisation

The Group’s organisation includes seven regions and functional departments. Each of the Group’s seven regions is headed by a regional director who is a member of the Group Executive Committee.

This organisation, built on clearly defined responsibilities and transparent governance, aims to facilitate the implementation of the Group’s strategic guidelines.

- ●the Strategy and Development Department, headed by Thibault Surer, to which the Strategic Planning, Marketing & Innovation, Partnerships, Economic Research, Data Lab and Information teams report;

- ●the Commercial Underwriting Department, headed by Cyrille Charbonnel. This department comprises the Risk Underwriting, Claims & Collections and Recovery, and Commercial Underwriting Departments;

- ●the Commercial Department, led by Nicolas Garcia;

- ●the Audit Department, led by Nicolas Stachowiak;

- ●the Finance and Risk Department, headed by Phalla Gervais;

- ●the General Secretariat, led by Carole Lytton, which includes the Legal, Human Resources, Compliance and Communications Departments;

- ●the Business Technologies Department, headed by Keyvan Shamsa;

- ●the Operations Department, headed by Declan Daly.

Within the key functions (risk, actuarial, compliance and audit), the links between the head office and the regional departments are hierarchical in nature, in order to strengthen the coherence of the orientations of these functions at the level of the whole Group, and to ensure the independence of the proper execution of control activities. For other functions, functional ties are organised according to the principle of a strong matrix organisational structure.

1.6.1Strategy and Development Department

- ●Strategic Planning, which is in charge of strategic planning, strategic research and the Group’s development through external growth;

- ●Marketing & Innovation, which analyses competition (market studies), determines client segmentation, defines the Group’s product and service offering and pricing, and leads the innovation/digitalisation strategy as well as projects in this area;

- ●the Partnership Department, in charge of developing and setting up new distribution and fronting agreements;

- ●Economic Research, which performs analysis and publishes macroeconomic research;

- ●the Data Lab, in charge of supporting modelling, innovation and digital transformation projects;

- ●Information, which aims to develop information services. It is tasked primarily with selecting and coordinating information providers and service centres to supply the databases used by risk underwriting teams.

-

1.7Information systems and processes

1.7.1General introduction

The use of efficient, reliable and secure information systems is a major challenge for the Group in the context of its commercial offerings; the digital experience provided to its clients through its products and services is an important development focus. It is also equally important for its management, reporting and internal control procedures, since it provides a global perspective on the Group’s activities, the completion of its strategic plans and its development, the management of its risks, and the follow-up given to internal and external audit report recommendations.

In recent years, the Group has focused on aligning its information systems with its strategic objectives, and modernising, unifying and securing its business data. This approach has continued under the new strategic plan, which affords great importance to the streamlining of processes and the automation of information systems. In accordance with its disaster recovery plan (DRP), all servers worldwide are hosted in two external data centres located in the Paris region in France, which will soon be supplemented with a third cold data storage solution. All data are backed up on a private cloud. These two sites combine the Group’s information system equipment (servers, storage, backups, network and telecommunications equipment, security, etc.). In the event of a failure at one of these two sites, the other takes over in a completely transparent manner for all users. The “information systems” component of the DRP is tested twice a year.

The Group has chosen to ensure a high level of expertise and quality in data management, and has chosen open information systems, which allow it to keep abreast of the technological developments needed for its activities, through a range of applications consisting of internally developed applications and software packages.

Furthermore, the Group’s information systems follow a quality process based on the ITIL (Information Technology Infrastructure Library) standard. Its development teams apply agile methods and an active certification process. As such, the Coface Group’s information systems have been ISO 9001 certified since 2000 (1).

Overall, thanks to this new architecture, maintenance costs have fallen and security and the assurance of business continuity have improved. The Group is committed to investing in its information systems, particularly to support its commercial and innovation strategy, while also controlling related expenses and investments.

With the pandemic, information systems now extend to staff members’ homes. In accordance with the business continuity plan (BCP), the Group has strengthened its resources to maintain the required level of security and availability outside the company’s premises. This period was also an opportunity for criminals to develop their activities. The Group therefore decided to strengthen its security by increasing the resources allocated to both human and technical security. Processes were reviewed to ensure that security is taken into account, existing solutions were improved, and new ones have been added. This work has already proven effective in countering these ever-increasing attacks.

-

1.8The Group’s regulatory environment

The Group is governed by specific regulations in each of the countries in which it operates its insurance or factoring activities, either directly, or through branches, subsidiaries or partnerships. In some jurisdictions, the activity of business information and/or debt collection may also be regulated.

1.8.1Credit insurance activities

General rules on oversight and control of the Group’s activities

The French Insurance Code (Code des Assurances), notably in Book III thereof, provides that an insurance company holding an authorisation from a Member State that allows it to perform its activities in one or more classes of insurance, may exercise these same activities, directly or through branch offices, under the European passport.

As an insurance company, Compagnie française d’assurance pour le commerce extérieur is subject to the provisions of the French Insurance Code and European Union regulations, in particular Solvency II. The Company and its branches in the European Union are placed under the supervision of the Autorité de contrôle prudentiel et de résolution (ACPR), an independent administrative authority. It ensures that insurance undertakings are always able to meet their commitments to their policyholders through the application of appropriate internal policies and a sufficient level of own funds. In this respect, level two controls have been put in place since 2008. They mainly relate to:

- ●regulatory licences and authorisations;

- ●compliance with personal data protection regulations;

- ●the implementation of procedures to guarantee the confidentiality of data;

- ●governance rules;

- ●compliance with anti-money laundering and counter-terrorist financing legislation;

- ●the Know Your Customer obligations incumbent on insurance companies; and

- ●the effectiveness of reporting procedures.

The Company, as a holding company for an insurance group, is likewise subject to the ACPR’s additional oversight as concerns compliance with the solvency standards (see Section 5.2.2 “Financial Risks”).

In accordance with Articles L.322-4 and R.322-11-1 to R.322‑11-3 of the French Insurance Code, any party, acting alone or in concert, that intends to increase or decrease its interest, directly or indirectly, in the share capital of the Company or Compagnie française d’assurance pour le commerce extérieur, such that the voting rights held by that party (or parties, in the case of a disposal or extension of interest made in concert) would go above or below the threshold of one tenth, one fifth, one third or one half of the voting rights in the Company or in Compagnie française d’assurance pour le commerce extérieur, is required to inform the ACPR of such plan and obtain its approval in advance. Pursuant to Article L.561-2 of the French Monetary and Financial Code, Compagnie française d’assurance pour le commerce extérieur is subject to the legislative mechanism relating to combating money laundering and the financing of terrorism. The current mechanism, codified under Title Six, Book V of the French Monetary and Financial Code, includes oversight of any practices whereby third parties would use insurance operations to engage in corruption or to reintroduce the proceeds of criminal offences into the legal economy. Transactions likely to be the result of an act of corruption, money laundering, or terrorism financing are analysed and, where applicable, result in a suspicious transaction report to TRACFIN (the French financial intelligence unit), which is the competent authority for these matters in France.

Following the entry into force in 2017 of the french law of December 9, 2016 on transparency, anti-corruption and the modernisation of economic life, known as the Sapin II law, the Group reviewed its internal procedures in order to verify their legal and regulatory compliance.

Prudential regime for insurance companies

The prudential regime for insurance companies, which applies to the Company as an insurance group as defined in Article L.356-1 5 of the French Insurance Code, comprises two aspects which govern their operation: a financial component on the one hand, and an accounting component on the other. The companies of the Group operating outside of the European Union are likewise subject to a prudential regime.

Financial aspect of the prudential regime for insurance companies

The regulations derived (i) from Directive No. 2009/138/EC of the European Parliament and of the Council of November 25, 2009 on the taking-up and pursuit of the business of insurance and reinsurance, transposed by ordinance and decree into the French Insurance Code in April and May 2015, and (ii) from its implementing texts, including the delegated regulations of the European Commission (“the Commission”), notably delegated Regulation (EU) 2015/35 supplementing the aforementioned directive, came into force on January 1, 2016 (together “Solvency II”).

The aim of Solvency II is, in particular, to achieve better understanding of insurers’ risks, and create a common system for all European Union members (see Section 5.2.2 “Financial risks”).

- ●the valuation of assets and liabilities;

- ●technical provisions;

- ●own funds;

- ●the Solvency Capital Requirement;

- ●the minimum capital requirement; and

In this regard, the insurance entities located in the European Union are branches of the Company. This makes it possible to pool all these entities’ assets and to leave only the minimum amount of cash required for operational requirements at the local level.

In other countries, regardless of the legal status of the entity concerned, the Group must comply with local regulations. To that end, the entities hold their asset portfolios and their cash locally in order to meet the asset-liability management and solvency requirements set by local regulators.

Accounting aspect of the prudential regime for insurance companies

In addition to the general accounting obligations enacted by Articles L.123-12 et seq. of the French Commercial Code, the Group is subject to specific accounting rules for insurance companies, which have been codified under Title IV, Book III of the French Insurance Code. In fact, the inversion of the production cycle that is specific to insurance activities, i.e. the fact of providing services with an actual cost that will only be known after the fact, justifies the existence of specific accounting rules for the companies that conduct these activities.

The Group’s consolidated financial statements are prepared in application of IFRS rules including IFRS 4, phase 1. This standard requires that the references used for insurance contracts as defined by IFRS be a recognised set of accounting guidelines. The Group has thus adopted the French principles to show the accounting of the insurance contracts. The provision for equalisation is not accepted under IFRS, and was thus eliminated in the IFRS financial statements. Furthermore, the Group must apply IFRS 4, paragraph 14, and specifically proceed to conduct liability adequacy tests.

IFRS 4 on insurance contracts will be replaced by IFRS 17 on January 1, 2023. In addition, IFRS 9 on financial instruments traded on spot or derivatives markets will be applicable to insurance holding companies on January 1, 2023.

Regulations applicable to credit insurance policies signed by the Group

The policies issued in each of the countries where it is present comply with the corresponding country’s regulations. In France, credit insurance policies issued by Coface are not subject to the provisions of the French Insurance Code but to those of the common law of contracts – with the exception of the provisions of Articles L.111-6 (major risks), L.112-2 (pre-contractual information), L.112-4 (content of insurance policies), L.112-7 (information to be provided when operating under the freedom to provide services) and L.113-4-1 (explanation due to the policyholder by the credit insurer upon termination of cover) of the French Insurance Code.

-

2. CORPORATE GOVERNANCE

2.1Structure and operation of the Board of Directors and its specialised Committees

2.1.1Details of the members of the Board of Directors for financial year 2022

Following the disposals carried out in 2021 between Natixis and Arch Capital Group, on January 6, 2022, Natixis sold its remaining stake in COFACE SA, representing 10.04% of the share capital, to institutional investors. Natixis no longer holds any shares in COFACE SA.

The disposal of this remaining stake had no impact on the organisation of the Board of Directors of COFACE SA, which is still made up of ten directors, including four appointed by Arch Capital and a majority of six independent directors, including the Chairman.

The tables, as well as the biographies, presented below are established as of December 31, 2022 and therefore do not take into account the change in the name of the Appointments, Compensation and CSR Committee (cf. Section “Appointments, Compensation and CSR Committee” in paragraph 2.1.8.).

Name

Personal information

Experience

Position on the Board of Directors

Age

Gender

Nationality

Number of shares

Number of offices held in listed companies (1)

Inde-

pendentStart of term/end of term

Attendance rate (2)

Board committees/

attendance rate (3)Bernardo Sanchez Incera

62

Spanish

1,000

1

✓

Feb. 10, 2021

2024 AGM

100%

ACC

100%

Janice Englesbe

54

American

1,000

-

Feb. 10, 2021

2024 AGM

100%

RC

100%

David Gansberg

50

American

1,000

-

Jul. 28, 2021

2024 AGM

90%

AAC

100%

Chris Hovey

56

American

1,000

-

Feb. 10, 2021

2024 AGM

100%

-

Isabelle Laforgue

42

French

1,000

-

✓

Jul. 27, 2017

2024 AGM

100%

AAC – 100%

RC – 100%

Laetitia Léonard-Reuter

Appointment on May 17, 2022

47

French

1,000

-

✓

May 17, 2022

2025 AGM

100%

AAC (Ch.)

100%

Nathalie Lomon

51

French

1,000

-

✓

Jul. 27, 2017

2024 AGM

80%

RC (Ch.)

100%

Sharon MacBeath

53

British

1,000

-

✓

Jul. 1, 2014

2025 AGM

90%

ACC (Ch.)

100%

Laurent Musy

Appointment on May 17, 2022

56

French

1,200

✓

May 17, 2022

2025 AGM

100%

RC

100%

Nicolas Papadopoulo

60

French

12,800

-

Feb. 10, 2021

2024 AGM

90%

ACC – 100%

Average (4)

53

50% (5)

50%

60%

95%

For the purposes of their corporate offices, the members of the Board of Directors are domiciled at the head office of the Company.

- With the exception of the office held within the Company.

- Average attendance rate at Board meetings.

- AAC: Audit and Accounts Committee – RC: Risk Committee – ACC: Appointments and Compensation Committee – Ch.: Chairman.

- Average on December 31, 2022.

- Percentage of women on December 31, 2022.

Female

Male

Changes in the composition of the Board of Directors and the Board Committees since the beginning of 2022

BOARD OF DIRECTORS / COMMITTEE

NAME

Nature of change

Date of decision

Board of Directors

Sharon MacBeath

Renewal of directorship

Shareholders’ Meeting of May 17, 2022

Board of Directors

Laetitia Léonard-Reuter

Appointment as independent director

Shareholders’ Meeting of May 17, 2022

Board of Directors

Laurent Musy

Appointment as independent director

Shareholders’ Meeting of May 17, 2022

Board of Directors

Olivier Zarrouati

Expiry of term as independent director

Shareholders’ Meeting of May 17, 2022

Board of Directors

Éric Hémar

Expiry of term as independent director

Shareholders’ Meeting of May 17, 2022

Audit and Accounts Committee

Laetitia Léonard-Reuter

Appointment as Chairman

to replace Éric HémarBoard of Directors’ meeting of June 8, 2022

Risk Committee

Laurent Musy

Appointment as member

Board of Directors’ meeting of June 8, 2022

Appointments and Compensation Committee

Sharon MacBeath

Appointment as Chairman

to replace Olivier ZarrouatiBoard of Directors’ meeting of June 8, 2022

-

2.2Chief Executive Officer and Group general management specialised committees

At the meeting of November 22, 2012, the Board of Directors decided to separate the roles of Chairman of the Board of Directors and Chief Executive Officer. This decision reflects the Company’s wish to comply with best practices in corporate governance and to clearly distinguish between the strategic, decision-making and supervisory duties of the Board of Directors, and the operational and executive duties of the Chief Executive Officer. This separation was expressly reiterated by the Board of Directors at its meeting of January 15, 2016 on the appointment of Xavier Durand and on his reappointment at the meeting held on February 5, 2020.

2.2.1Experience and offices of the Chief Executive Officer

For the purposes of this Universal Registration Document, the Chief Executive Officer is domiciled at the Company’s head office.

Xavier DURAND

Age: 58

Expiration date of the term of office: Ordinary Shareholders’ Meeting called to approve the financial statements for the financial year ended December 31, 2023

264,500 shares (180,000 in registered form and 84,500 bearer shares)

(see Section 7.2.9 “transactions carried out by persons with executive responsibilities”)

Chief Executive Officer

since February 9, 2016

Curriculum Vitae

Xavier Durand is a graduate of the École Polytechnique and the École Nationale des Ponts et Chaussées. He started his career in 1987 with consultancy firm The Mac Group (Gemini Consulting) before joining Banque Sovac Immobilier in 1994 as deputy CEO. In 1996, Xavier Durand joined GE Capital, where he led an international career, first in Chicago as Director of Strategy and Growth in the finance division of the Global Auto business, then in France, first as CEO of GE Money Bank France, then CEO for Europe of GE Money and GE Capital’s banking activities. In 2011, he was named CEO of GE Capital Asia-Pacific, based in Japan. He was appointed GE Capital’s Director of Strategy and Growth, based in London, at the end of 2013. He has been Chief Executive Officer of COFACE SA since February 9, 2016.

Principal terms of office and duties

During financial year 2022

- ●Chairman of the Board of Directors and Chief Executive Officer of Compagnie française d’assurance pour le commerce extérieur

- ●Chairman of the Board of Directors of Coface North America Holding Company

- ●Director and Chairman of the Audit and Internal Control and Risk Committee of: ALD Automotive (1)

During the past five years and which are no longer held

- ●N/A

-

2.3Compensation and benefits paid to managers and corporate officers

The Company refers to the AFEP-MEDEF Code to prepare the report required by Article L.225-37 of the French Commercial Code.

The tables included in the sections below present a summary of compensation and benefits of any kind that are paid to corporate officers of the Company, and to members of the Company’s Board of Directors by:

- the Company,

- companies controlled, pursuant to Article L.233-16 of the French Commercial Code, by the company in which the mandate is performed,

- companies controlled, pursuant to Article L.233-16 of the French Commercial Code, by the Company or companies that control the company in which the mandate is performed and

- the Company or companies that, pursuant to the same article, control the company in which the mandate is exercised. Since the Company belongs to a group at the date of this Universal Registration Document, the information concerns the amounts owed by all companies in the chain of control.

The Company is a limited corporation (société anonyme) with a Board of Directors. The duties of Board Chairman, performed by Bernardo Sanchez Incera since February 10, 2021, and Chief Executive Officer, performed by Xavier Durand, have been separated.

Xavier Durand is compensated by the Company for his functions as Chief Executive Officer as described in Sections 2.3.2 and 2.3.3 below.

2.3.1Employee compensation policy

Regulatory framework

The Company’s compensation policy is in line with the provisions of Directive 2009/138/EC of the European Parliament and of the Council of November 25, 2009 on the taking-up and pursuit of the business of Insurance and Reinsurance (Solvency II) and Delegated Regulation (EU) 2015/35 of the European Commission of October 10, 2014 (Article 258(1), point 1 and Article 275).

Generally speaking, compensation practices should contribute to effective risk management at the Company, and in particular:

- ●ensure strict compliance with the laws and regulations applicable to insurance companies;

- ●prevent conflicts of interest and not encourage risk-taking beyond the limits of the Company’s risk tolerance;

- ●be consistent with the Company’s strategy, interests and long-term results;

- ●guarantee the Company’s capacity to keep an appropriate level of own funds.

In this context, Coface’s compensation policy specifies general provisions applicable to all employees according to certain criteria and provisions specific to regulated categories of employees within the meaning of the Solvency II Directive.

General principles

The compensation policy is a key instrument in implementing Coface’s strategy. It seeks to attract, motivate and retain the best talent. It encourages individual and collective performance and seeks to be competitive in the market while respecting the Group’s financial balance. It complies with the regulations in force, guarantees internal equity and professional equality, particularly between men and women. It incorporates social and environmental issues.

It is proposed by the Group’s HR Department and is reviewed by the Appointments, Compensation and CSR Committee, and then subject to approval by the Board of Directors. The HR function is responsible for implementing the policy at the country level to ensure practices are consistent within the Group, and to ensure each country is compliant with local regulations and remains competitive in the market.

Structured in a clear and transparent manner, compensation is intended to be adapted to the Group’s objectives and to assist it in its long term development strategy:

- ●fixed compensation: this is the principal component of individual compensation and depends on the abilities and expertise expected for a given position. It is set at the time of hiring and reviewed annually in light of market practices, individual contribution and internal equity in strict compliance with the budgets allocated for the financial year;

- ●annual individual variable compensation (“bonus”): the Group’s variable compensation policy takes individual and collective performance over a given year into account and is assessed on the basis of financial and non-financial criteria. The eligibility rules and variable compensation level are set by function, responsibility level and market under consideration.

- For the Group’s Senior Managers (Top 200), the target variable compensation is set as a percentage of the base salary and may not exceed 100% of this. Variable compensation is awarded based on objectives set annually by the Management Board and the managers of each function, with the support of the Group’s HR Department. This procedure ensures that individual objectives are consistent with the Company’s strategic objectives:

- ●for the front office functions:

- ●quantitative objectives related to the financial performance of the operating entity account for 15% of variable compensation,

- ●predominantly quantitative objectives related to the performance of the function in question account for 45%,

- ●40% of the objectives are determined individually during the annual performance review meeting. These may be quantitative and/or qualitative objectives, provided that they comply with SMART rules (specific, measurable, attainable, relevant and time-bound);

- ●for the control and support functions, the quantitative objectives linked to the financial performance of the operating entity account for 30%, and targets set individually for 70% of the total,

- ●furthermore, to avoid any conflict of interest, for the control functions referred to in Articles 269 to 272 (audit, risk, compliance), the collective part of annual variable compensation based on financial objectives is assessed using the Group scope, irrespective of the employee’s level of involvement, to prevent them from being directly assessed on the performance of the units placed under their control;

- ●for the front office functions:

- ●Long-Term Incentive Plan: since 2016, the Group has awarded performance shares to two types of employees each year:

- ●employees identified under the Solvency II Directive, which imposes a system for deferred total variable compensation. This category includes members of the Executive Committee, key functions and employees having a significant influence on the company’s risk profile,

- ●key employees as part of a reward and retention process. This plan also ensures that the interests of the beneficiaries are aligned with those of the shareholders over the long term;

- ●collective variable compensation (employee savings): in France, the Group negotiated a three-year profit-sharing agreement in 2021. This agreement benefits all employees on a fixed or open-ended employment contract, who have more than three months’ seniority within the companies forming part of the Compagnie française d’assurance pour le commerce extérieur – Fimipar economic and corporate unit (a wholly-owned subsidiary of the Group). Participation is handled according to the legal formula. Similar collective schemes exist in other Group entities depending on their legal obligations with a view to giving employees a stake in the Company’s performance;

- ●corporate benefits: employee benefits are determined by each Group entity in order to be as close as possible to local concerns. The Group ensures consistency of practice and guarantees a level of social protection that is competitive in the market and respectful of its employees worldwide. In order to meet the need for fairness and competitiveness in the compensation of members of the Executive Committee, the Board of Directors decided, at its meeting of February 15, 2022, to implement a supplementary pension plan for members of the Executive Committee who do not have a specific scheme. The main features of this plan are:

- ●defined contribution pension scheme (in France, in the form of an insurance policy governed by Article 82 of the French General Tax Code),

- ●contribution of 10% of the beneficiary’s base salary (invested in the plan, with compensation for additional charges and taxes),

- ●withdrawal as a lump sum or an annuity on liquidation of pension entitlements.

In 2020, the Group implemented a car policy aimed at harmonising practices and reducing the carbon impact of its vehicle fleet. It is gradually replacing its high-emission vehicles with petrol, hybrid or 100% electric vehicles.

The compensation of employees is wholly or partly comprised of these components, depending on the position held, the level of responsibility and the reference market.

Special provisions applicable to Solvency II regulated categories of employees

Scope of regulated categories of employees

Pursuant to the provisions of Article 275, Section 1, Point (c) of Regulation 2015/35, Coface has identified the following functions as falling within the scope of regulated categories of employees:

- ●members of the Executive Committee including general management, the finance and risk, strategy, operations, specialised product lines, business technology functions, the General Secretariat (legal, compliance, human resources and communications), human resources, sales, risk underwriting, information, claims & recovery and collection, and regional managers;

- ●persons holding the key functions described in Articles 269 to 272 of Regulation 2015/35: audit, risk, and actuarial (compliance key function is exercised by the General Secretariat);

- ●persons whose professional activity has a material impact on the Company’s risk profile: compliance, risk underwriting, commercial underwriting, credit risk support, investment, reinsurance, economic research, financial communication, country managers where turnover exceeds a proportion of the Company’s total turnover determined each year.

In 2022, 31 employees fell within the regulated category. The Appointments, Compensation and CSR Committee reviews these functions, then presents them to the Board of Directors for approval. This list is reviewed each year in order to guarantee a perfect match between the evolution of the Company’s risk profile and the identification of employees.

Specific provisions regarding compensation

The Group endeavours to ensure that the proportion and structure of variable compensation are balanced and that the goals set are in accordance with the Company’s strategy and risk profile.

In addition to rules common to all employees, the Group sets specific compensation rules intended for regulated categories of employees:

- ●the variable compensation package therefore includes the annual variable compensation (bonus) and long term variable compensation (Long-Term Incentive Plan) in the form of free performance shares;

- ●performance shares constitute the deferred component of total variable compensation and account for at least 30% of the total amount (1). They are contingent upon presence and performance conditions and have a vesting period of three years;

- ●all risk hedging transactions are prohibited.

-

3. COMMENT ON THE FINANCIAL YEAR

(1)Group estimates.3.1Economic Environment

After a post-Covid rebound of 5.9% in 2021, the global economy slowed to 3.0% in 2022 (at market exchange rates). The trend can largely be explained by the slowdown in China resulting from its zero-Covid policy, given the country’s weight in the global economy. The slowdown can also be attributed to the surge in inflation, at 8.0% in 2022 compared with 4.3% in 2021. Commodity and intermediate prices soared while supply chains failed to return to normal.

Inflation also spiked following Russia’s invasion of Ukraine on February 24. The outbreak of hostilities was followed by extensive sanctions and counter-sanctions that impacted trade and financial exchanges with the two countries, along with Belarus. Russia and Ukraine play a major role in global trade in agricultural products, fertilisers, minerals and hydrocarbons.

Central banks in developed economies joined those in emerging economies having tightened their monetary policy in second-half 2021 to combat inflation and support their currencies against the dollar, the latter boosted by rising uncertainties. Governments once again intervened to mitigate the impact of galloping energy and food prices on households. As a result of this aid, and the savings accumulated during the pandemic, consumption proved resilient in the first half of the year. Companies also benefited from support measures to cope with rising production costs. But this did not prevent companies in energy-intensive sectors, such as glass, fertilisers, metallurgy, paper-cardboard, food or construction materials, from reducing or halting production at some plants as they were unable to pass on the increase in their costs. In this respect, a distinction must be made between regions with relatively cheap energy, such as the Middle East and North America, and the rest.

Despite the dip in certain commodity prices in the second half, global trade increased in value (1) by USD 32,000 billion, 13% higher than in 2021 and 27% higher than in 2019. Trade in goods came out at USD 25 trillion, up 10% and 32% respectively. At USD 7 trillion, trade in services increased 15% and 11% respectively. In volume terms (2), trade in goods rose by nearly 3% in 2022 compared with 2021, with strong momentum in the first half of the year giving way to a sharp slowdown in the second half. Trade in services, which also returned to its pre- Covid peak in the second quarter, slowed less sharply.

With growth of 2.6% in 2022 (after 5.3% in 2021), the economies of developed countries slowed as a whole. The trend began in the last few months of 2021, when all sectors were impacted by numerous shocks, including supply issues, an increase in energy, materials and food prices, workforce shortages, and a fresh wave of Covid-19 with the Omicron variant. However, the main cause of the trend is the outbreak of war in Ukraine at the end of February 2022, which exacerbated the rise in producer and consumer prices. With inflation impacting all products, and wages rising substantially in some countries, central banks have been forced to raise interest rates vigorously.

Growth in Western Europe came out at 2.6% in 2022 (after 4.5% in 2021). The figure would have been even lower if the autumn had not been mild, reducing the need for heating and easing pressure on energy prices. There were also considerable disparities in growth.

- ●Portugal, Spain, Austria and Greece (with growth of 6.5%, 5.5%, 4.8% and 4.5%, respectively) took full advantage of the strong rebound in tourism.

- ●Spain and Portugal also benefited from a relatively lower energy price environment.

- ●While Greece capitalised on its vital role in maritime transport.

- ●The Irish economy (11.1%) was buoyed by the strength of the pharmaceutical and IT industries, as well as the robust results of the European head offices of global groups attracted by the country’s tax benefits.

- ●The UK economy (4.4%) slowed throughout the year, going as far as stagnation. Consumption and investment were negatively impacted by high inflation and tighter credit.

- ●Meanwhile, the Netherlands (4.2%), Western Europe’s trade gateway, benefited from the higher value of trade.

- ●Belgium, Denmark, France, Italy, Norway and Sweden ranked in the middle with growth of between 2.5% and 3.5%.

- ●The tourism industry offset industrial and energy issues in France and Italy, while Scandinavian countries benefited from their advantageous positioning in energy, electronics and pharmaceuticals.

- ●At the bottom of the rankings, Germany (1.8%) suffered from its dependency on mechanical and automotive exports to China.

- ●the US economy also slowed sharply, with growth of 1.9% in 2022, after 5.9% in 2021. Despite its weak trade links with Russia and Ukraine and its status as a net exporter of energy and other commodities, the US still suffered from the rise in global commodity prices. It also faced a decline in its labour force participation rate following Covid, which kept wages high. The Fed took aggressive action to deal with inflation by raising interest rates. The resulting increase in the cost of credit and the sharp drop in stock market values weighed on investment, particularly in the construction sector. Consumption held up better due to the savings accumulated during the pandemic;

- ●Canada, with growth of 3.5%, fared better than its neighbour owing to its higher share of commodity exports;

- ●the Australian economy (3.4%) held up relatively well despite a slowdown in domestic demand driven by inflation and monetary tightening;

- ●Israel (5.0%) benefited from its autonomous gas supply, the arrival of Russian and Ukrainian immigrants, its high-tech focus, and relatively limited inflation;

- ●Japan’s economy slowed to 1.1%, a weak performance but in line with its potential. The export sector suffered from China’s poor form, while its imports bill rose. In addition, consumers faced inflation exacerbated by the depreciation of the yen;

- ●South Korea (2.6%) was also negatively impacted by weaker external demand, particularly for its semiconductors.

Emerging and developing economies expanded by 3.6% in 2022 after 6.7% in 2021. However, there were wide disparities between regions and countries.

The Middle East and North Africa region is the only emerging or developing region that posted higher economic growth in 2022 than in 2021, with 5% after 4.4%.

- ●Unsurprisingly, oil- and gas-producing countries benefited from the high prices: Algeria (+4.5% after +3.5%), Saudi Arabia (+7% after +3.2%), United Arab Emirates (+6.0% after +3.8%), Iraq (+9% after +7.7%), Oman (+5.5% after +3%), and Qatar (+5.0% after +1.6%).

- ●Iran recorded modest growth (3.5%) for the third year in a row despite international sanctions.

- ●The Egyptian economy grew 6.5% (after only 3.3% due to the pandemic) over its 2021-2022 fiscal year thanks to the Suez Canal, natural gas and public investment. But activity slowed sharply in the second half of the year on high inflation, tighter credit and import restrictions.

- ●In contrast, growth dipped in Morocco (1.0% after 5.7%) owing to poor harvests caused by drought.

- ●Growth also declined in Tunisia (2.2% after 3.3%) on inflation and political and social difficulties.

With growth of 3.7% in 2022, after 7.2% in 2021, emerging Asia confirmed its resilience to external shocks:

- ●as the slowdown resulted from China’s poor health (3.0% after 8.1%) caused by its zero-Covid strategy and the tightening of regulations on real estate activity. However, the relative isolation of its food market and advantageous prices on Russian oil and gas helped contain inflation, while public investment in infrastructure boosted domestic demand;

- ●the Indian economy proved resilient (6.8% in 2022, after 8.3% in 2021) despite the impact of inflation (particularly food prices) and higher interest rates on domestic demand. The strength of its pharmaceutical exports and IT services contributed positively;

- ●growth in Indonesia rose from 3.7% in 2021 to 5.3% in 2022 on strong momentum in coal, nickel and palm oil exports. Its post-COVID reopening boosted tourism and domestic demand;

- ●growth in Malaysia (8.0% after 3%), Vietnam (7.9% after 2.6%) and the Philippines (7.1% after 5.7%) also picked up thanks to domestic demand, electronic exports and tourism.

- ●In Thailand, the improvement (from 1.6% to 3.2%) was limited by the delayed and only partial return of tourists, despite the strength of electronics and automotive exports.

- ●Brazilian growth came out at 2.9% (after 5.0% in 2021). Domestic demand held up strongly despite tighter credit and high inflation, as social transfers, tax exemptions and employment growth played their part. Mineral and agricultural exports prospered.

- ●In Argentina, growth slowed throughout 2022 to 5.1% (after 10.3% in 2021). Consumption and investment collapsed due to skyrocketing inflation and restrictions on capital movements and imports, while strong agricultural exports were offset by energy prices.

- ●Colombian growth held up well (8.0% in 2022 after 10.7% in 2021), boosted by sales of coal, oil and gold, with consumer spending underpinned by strong employment and wages.

- ●In Peru, growth slowed throughout 2022 to just 2.5% over the year, after 13.6% in 2021. This can be attributed to the impact of strikes in copper mines (the price of which has fallen) and political chaos, which dampened investment. Meanwhile, consumption held up well thanks to fiscal support measures and a new scheme allowing savers to withdraw their money from pension funds.

- ●In Mexico, growth was down from 4.8% in 2021 to 2.6% in 2022, with domestic consumption, boosted by employment, with wages and expatriate remittances proving resilient.

- ●In Chile (2.7%), domestic demand was hit by inflation, tighter credit and rising unemployment as well as a decline in Chinese demand for copper.

- ●In Nigeria, growth varied little (down from 3.6% in 2021 to 3.2% in 2022) and remains relatively low relative to the country’s population growth. The country benefited only minimally from high oil prices as a result of operating constraints, while agriculture was impacted by insecurity and flooding.

- ●In South Africa, growth came in at 2.1% in 2022 after 4.9% in 2021. The impact of rolling blackouts and flooding in KwaZulu-Natal on mining was offset by strong domestic demand supported by social transfers. These were facilitated by an improvement in the fiscal position thanks to increased revenue from mineral exports.

- ●The recovery was confirmed in both Angola (3.2% in 2022 after 0.8% in 2021) due to the increase in oil revenues, and Mozambique (3.9% after 2.3%) thanks to coal, aluminium and electricity.

- ●In Kenya, activity held up well (5.3% in 2022 after 7.5% in 2021) thanks to the post-Covid rebound, despite the impact of imported inflation, which was exacerbated by the impact of drought on agriculture in the north.

- ●In Ethiopia, growth shrank from 6.5% in 2021 to 3.5% in 2022, with the war in Tigray, the suspension of international aid and drought continuing to have a negative impact.

- ●Growth remained strong in Tanzania (4.5% in 2022 after 4.9% in 2021), with tourism and gold mining continuing to expand and infrastructure construction maintaining momentum.

- ●In Ghana, growth fell from 5.4 to 3.6% due to runaway inflation and the corresponding increase in the cost of credit, despite the strong performance of oil, gold and cocoa.

- ●Finally, in Côte d’Ivoire, growth remained strong (5.0%), driven by agricultural exports, the agri-food industry and relatively controlled inflation thanks to government measures.

- ●Poland followed this pattern (4.4% in 2022, after 6.8% in 2021). Excluding inflation, consumer spending continued to benefit from rising wages in a tight labour market and from the arrival of many Ukrainians. This partially offset the slowdown in exports.

- ●Hungarian growth held up well (5.2% after 7.1%), for the same reasons.

- ●In the Czech Republic, growth fell from 3.5% to 2.5% owing to sluggish consumption resulting from inflation and a sharp drop in exports as industry suffered from input shortages.

- ●Conversely, Romanian growth increased considerably, from 5.1% to 5.8%, thanks to strong momentum in private consumption boosted by substantial inflows of Ukrainians.

- ●Further to the east, Turkey saw its growth contract from 11.4% in 2021 to 5.5% in 2022. While consumer spending was hit by inflation, exports benefited from the rebound in tourism and the country’s role in offering an alternative to Asian products.

- ●Ukraine’s economy collapsed by 35% due to the war.

- ●While Russia managed to limit the decline to 3.5% thanks to oil and gas revenues. Regarding the gas sector, the positive price effect trumped the negative volume effect, while China and India provided an alternative to Europe for oil exports.

- ●Lastly, Kazakhstan, which was unable to fully benefit from its oil owing to a problem with a pipeline to the Caspian Sea, achieved growth of 3.3% in 2021, up from 2.6% in 2022.

/Change in GDP growth by country (3):

- ●Portugal, Spain, Austria and Greece (with growth of 6.5%, 5.5%, 4.8% and 4.5%, respectively) took full advantage of the strong rebound in tourism.

-

3.2Significant events of 2022

3.2.1Governance evolution

In the Board of Directors

On May 17, 2022, during the Combined General Meeting, Laetitia Leonard – Reuter and Laurent Musy have been elected as independent directors for a term of four years. These appointments follow the expiration of the terms of office of Olivier Zarrouati and Éric Hémar, respectively.

Thus, at the close of the General Meeting, the Board of Directors is composed of 10 members, 5 women and 5 men, the majority (6) of whom are independent directors.

In the Executive Committee

On May 2, 2022, Hugh Burke has been appointed as the CEO of Coface Asia-Pacific region, effective on April 1, 2022. He joins the Group Executive Committee and reports to Xavier Durand, Coface CEO. He takes over from Bhupesh Gupta.

On September 8, 2022, Matthieu Garnier, Group Information Services Director, joined the Group Executive Committee and will continue to report to Thibault Surer, Group Strategy & Development Director. This decision is part of our strategy to develop information services, one of the major pillars of our Build to Lead plan.

-

3.3Comments on the results as at December 31, 2022

3.3.1Group performance

Consolidated turnover amounted to €1,812.0 million, up 13.4% on 2021 at constant FX and perimeter. The net combined ratio stood at 64.9%, or 0.3 points above the level recorded in 2021 (64.6%). This breaks down into a 2.7-point increase in the loss ratio to 36.0% and a 2.5-point decline in the cost ratio to 28.8% compared with 2021. The Group ended the year with net income (Group share) up 26% at €283.1 million (vs. €223.8 million in 2021) and return on equity of 15.6%.

The target solvency ratio ranges between 155% and 175%. The solvency ratio is estimated at 200.53% at December 31, 2022 (1). Coface will propose the payment of a dividend (2) of €1.52 per share to shareholders, representing a payout ratio of 80%.

-

3.4Group cash and capital resources

Information in this section is derived from the statement of cash flows in the consolidated financial statements and from Note 9 “Cash and cash equivalents” in the Company’s consolidated financial statements.

3.4.1 Coface Group debt and sources of financing

The Group’s debt comprises financial debt (financing liabilities) and operating debt linked to its factoring activities (composed of “Amounts due to banking sector companies” and “Debt securities”).

Financial debt

For the year ended December 31, 2022, the Group’s financing liabilities, totalling €534.3 million, are comprised of two subordinated loans.

- ●A fixed-rate issue (4.125%) of subordinated notes carried out by COFACE SA on March 27, 2014 for a nominal amount of €380 million, maturing on March 27, 2024.

- The securities are irrevocably and unconditionally guaranteed on a subordinated basis by Compagnie française d’assurance pour le commerce extérieur, the Group’s main operating entity.

- COFACE SA redeemed €153 million of the subordinated bonds issued in 2014 at a fixed price of 103.625% on September 21, 2022.

- The nominal amount after this redemption stands at €227 million, still maturing on March 27, 2024.

- ●A new fixed-rate issue (6.000%) of subordinated notes on September 22, 2022, for a nominal amount of €300 million, maturing on September 22, 2032.

Operating debt linked to the factoring business

This debt, which includes the “Amounts due to banking sector companies” and “Debt securities” items, provides refinancing for the Group’s factoring companies (Coface Finanz in Germany and Coface Poland Factoring in Poland).

Amounts due to banking sector companies, which correspond to drawdowns on the bilateral credit lines (see “Bilateral credit lines” below) set up with various banking partners of Coface Finanz and Coface Poland Factoring and the Group’s local banks, amounted to €743.2 million for the financial year ended on December 31, 2022.

Debt securities amounted to €1,794.9 million for the financial year ended on December 31, 2022, including:

- ●senior units issued by the VEGA securitisation fund under the Coface Finanz factoring receivables securitisation programme (see “Securitisation programme” below), in the amount of €1,180.5 million; and

- ●commercial paper issued by COFACE SA (see “Commercial paper programme” below) to finance the activity of Coface Finanz in the amount of €614.3 million.

Coface Group’s main sources of operational financing

- ●a securitisation programme to refinance its factoring receivables for a maximum amount of €1,200 million;

- ●a commercial paper programme for a maximum amount of €700 million; and

- ●bilateral credit lines for a maximum total amount of €1,676.6 million.

In 2022, the securitisation programme was increased to €1,200 million and renewed early in March; the senior one-year units were renewed in December. Coface Poland Factoring’s syndicated multi-currency loan was renewed early in the amount of €310 million. This loan has a two-year maturity with two options for a one-year extension, at the lenders’ discretion. In May, the option to extend the fourth year of the syndicated loan serving as a back-up to COFACE SA’s €700 million commercial paper programme was exercised.

At December 31, 2022, Coface Group’s debt linked to its factoring activities amounted to €2,538 million.

a)Securitisation programme

To refinance its factoring activities, in February 2012 the Group set up a securitisation programme for its factoring trade receivables, guaranteed by Compagnie française d’assurance pour le commerce extérieur. In March 2022, the securitisation programme was renewed early and its maximum amount was increased to €1,200 million. USD units were created (maximum amount equal to 25% of the total maximum amount of the transaction) following the inclusion of US clients and debtors in the transaction.

This securitisation programme includes a number of standard acceleration clauses associated with such a programme, concerning the financial position of Coface Finanz (the ceding company) and other Group entities (including certain indicators regarding the quality of the ceded receivables), and linked to the occurrence of various events, such as:

- ●payment default of Coface Finanz or of Compagnie française d’assurance pour le commerce extérieur for any sum due under the securitisation fund;

- ●the cross default of any Group entity pertaining to debt above €100 million;

- ●closure of the asset-backed commercial paper market for a consecutive period of 180 days;

- ●winding-up proceedings concerning Coface Finanz, Coface Poland Factoring, the Company or Compagnie française d’assurance pour le commerce extérieur;

- ●the discontinuance of or substantial change to the activities practised by Coface Finanz or by Compagnie française d’assurance pour le commerce extérieur;

- ●a downgrading of the financial rating of Compagnie française d’assurance pour le commerce extérieur to below BBB- for the main funding (maximum amount of €1,200 million) and to below A for additional funding (maximum amount of €100 million);

- ●non-compliance with one of the covenants linked to the quality of the portfolio of ceded factoring receivables.

The securitisation programme does not contain a change of control clause for the Company, but contains restrictions regarding a change of control in Compagnie française d’assurance pour le commerce extérieur and the factoring companies resulting in their exit from the Group.

Covenant

Definition

Trigger threshold

Default ratio

Three-month moving average of the rate of unpaid receivables beyond 60 days after their due date

> 2.24%

Delinquency ratio

Three-month moving average of the rate of unpaid receivables beyond 30 days after their due date

> 5.21%

Dilution ratio

Three-month moving average of the dilution ratio

> 9.71%

b)Commercial paper programme

The Group has a €700 million commercial paper issuance programme under which the Company frequently issues securities with due dates ranging generally between one and six months. At December 31, 2022, securities issued under the commercial paper programme totalled €614.3 million. The programme was rated P-2 by Moody’s and F1 by Fitch.

Should the commercial paper market shut down, since July 28, 2017 the Group has had a currently unused syndicated loan covering the maximum amount of the commercial paper issue programme (€700 million since August 2021). The agreement regulating this syndicated loan contains the usual restrictive clauses (such as a negative pledge clause, prohibition from assigning the assets outside the Group above a specified threshold or restrictions related to the discontinuance or any substantial change in the Group’s business activities) and early repayment clauses (payment default, cross default, non-compliance with representations, warranties and commitments, significant adverse change affecting the Company and its capacity to meet its obligations under these bilateral credit lines, insolvency and winding-up proceedings), in line with market practices. This syndicated loan was renewed in August 2021 for three years with two possibilities for an extension of one year each. The first extension option was exercised in 2022.

c)Bilateral credit lines

To refinance its factoring business, the Group also set up a number of bilateral credit lines and overdraft facilities, mainly through its subsidiaries, for a total maximum amount of €1,676.6 million:

- ●bilateral credit lines and overdraft facilities with local banks for a maximum of €592.7 million, of which €32.9 million had been drawn in Germany and €0.9 million in Poland at December 31, 2022

- ●bilateral credit lines concluded with banks:

- ●six lines for a maximum total amount of €425 million for Coface Finanz (with maturities ranging between one and three years), of which €314 million had been drawn down as of December 31, 2022,

- ●five lines (including a syndicated loan) for a maximum total amount of €658.9 million for Coface Poland Factoring (with maturities ranging between one and three years), of which €394 million had been drawn down as of December 31, 2022

-

3.5Post-closing events at December 31, 2022

3.5.1Acquisition of North America data analytics boutique Rel8ed

-

3.6Outlook

3.6.1Economic environment

In 2023, global economic growth is expected to slow to 1.9% from 2.9% in 2022. Emerging countries, with the exception of China, should be the main contributors to growth. The major advanced economies, excluding Japan and Australia, are expected to see their growth slow sharply to between -1% and +1%. This decline will be due in part to sluggish growth in Europe at the turn of 2022-2023, as well as in the United States starting in the second quarter of 2023.

The general context will continue to be dominated by the fallout from the war in Ukraine and, to a lesser extent, the impact of weather events. In economic terms, this will translate into price increases in food, energy, materials, industrial components and in certain services such as transport, restaurants and trade. In turn, inflation and the associated tightening of credit will continue to put pressure on global activity by weighing on demand (consumption, investment) and supply (industrial production and services).

Global inflation is expected to fall to 6% in 2023 after 8% in 2022. This decline will be largely due to a favourable base effect. Moreover, the inflation profile is not expected to be uniform over 2023, with – barring a marked fall in temperatures in Europe – a drop in the energy component until the summer. This phase will be followed by a recovery in the second half of the year, when China’s activity accelerates and its need for energy, particularly for liquefied natural gas, increases.

While Russian oil refused by Europe has been able to find alternative buyers in Asia (China and India in particular) thanks to the availability of oil ships, substitution should not be as easy for gas. Gas not being exported to Europe is in fact mainly located in the western part of Russia, the few pipelines to Asia are saturated, and few LNG tankers are accessible to Russia. The same problem could arise when the European embargo on refined petroleum products, particularly diesel, takes effect in February 2023.

For gas and diesel, Europe and China are likely to be in competition to buy the small quantities that are available. However, no significant additional production of these products is expected worldwide in 2023, at least not in sufficient quantities. The installation of floating storage and regasification units along northern European coasts will only enable the replacement of gas transported by pipeline with liquefied natural gas. A cessation of hostilities in Ukraine would not change the situation on the energy (and metals) market, as Europe could refuse to lift its sanctions or resume its purchases of products from Russia.

However, it could further ease pressure on agricultural markets and fertilizers by facilitating their production in Ukraine and their transport through the Black Sea. The availability of agricultural products will, however, continue to depend on weather conditions, which appear to be more favourable in terms of rainfall in the major producing regions. Finally, restricted by worsening public finances, governments could gradually reduce measures to protect consumers and businesses from price rises, thereby fuelling inflation. Similarly, low unemployment in advanced regions will encourage wage growth, sustaining inflationary dynamics yet failing to safeguard purchasing power.

This relatively more favourable inflationary dynamic should allow advanced economies’ central banks to curb their monetary tightening, or even stop raising interest rates. They can rightly consider that the return to previous levels of inflation would be too costly in social terms, since inflation has spread beyond the products first affected and has grown increasingly opaque, and due to the unavoidable rise in costs resulting from the securisation of supply chains. However, this easing in monetary policy will not prevent the 2022 rate hikes from impacting activity, given the 6-9 month lag generally observed in economies with developed financial systems.

It could have a significant impact on housing and office construction. Markets where housing prices have risen sharply, while household debt is high and home loan interest rates variable, such as North America, Northern Europe and Australia, are the most exposed. Office construction is likely to suffer the effects of widespread remote working. Emerging economies are also likely to ease their monetary policy, especially as they began to tighten policy before the advanced economies. In addition to the reasons already given, it should be added that the dollar’s rise (and the concomitant depreciation of emerging currencies), which is probably a more pressing concern for these countries than inflation, seems to have ended.

After the shock of the pandemic, higher energy prices and rising interest rates, many governments’ public and external debt is also likely to attract attention. In addition to those that have already defaulted, such as Sri Lanka and Ghana, and/or benefited from debt restructuring, a few countries (especially in Africa, Asia and America), facing rising food and energy bills, may encounter difficulties in servicing their debt. Fortunately, the injection of funds by their foreign partners and multilateral funded programmes will reduce the risk of default.

It will be important to distinguish between winners and losers from the new global economic conditions. In an environment of high commodity prices, it is important to differentiate between net exporters and importers of energy, minerals, metals and agricultural products. Some countries enjoy near-energy and/or agricultural independence, which protects them in part from the rise in global prices. Others will start or ramp up their production of raw materials. This will be the case for hydrocarbons and for the essential elements of renewable energies: the mining of the minerals needed for batteries (lithium, cobalt, nickel, manganese, etc.), the production of solar, wind and hydraulic energy, as well as green hydrogen. For these countries, it will be an opportunity to attract strong domestic or foreign investment.

Countries that rely on tourism should benefit as international tourism returns to normal as already observed in some countries. Finally, the disruption in supply chains during the Covid crisis and the desire to decrease dependency on China may be an opportunity for some countries (Turkey, Mexico, North Africa, Eastern Europe, South and South-East Asia) to gain new business.

The Chinese growth profile will have an impact on global inflation through its imports of energy and minerals, and on growth in many commodities-exporting countries as well as those that export capital goods and high-tech products. It is likely that China will manage to curb the Covid wave in the second half of the year and that its growth will then accelerate. Indeed, the worst affected are mostly older people, which allows others to ensure production and spend.

The authorities have opted to lift most restrictions on movement, which was not the case in Western countries. Activity is also expected to be boosted by the accommodative economic policy adopted in autumn 2022. The real estate sector, which accounts for a huge part of the economy, could nevertheless remain a burden. Indeed, even if the authorities have bailed out major developers, the very strict rules (“red lines”) adopted in December 2021 will continue to apply. Construction, for its part, should continue to benefit from public sector orders for social housing and infrastructure.

Apart from China, the G20 economies are split between those from the Asia-Pacific region, which will be resilient, and the rest, which will decline, although all but four (Italy, France, India and Japan) should see a fall in inflation. Moreover, the performances of economies exporting goods or services (including tourism) to China are still dependent on the country.

- ●South Korea (2.0% growth expected in 2023 after 2.6% in 2022), Japan (1.5% after 1.1%), India (5.9% after 6.8%) and Indonesia (5.1% after 5.3%) will benefit from domestic demand being supported by the authorities and from a post-Covid catch-up, while their exports will weaken.

- ●Australia (2.2% after 3.4%) will continue to profit from its coal and gas, while wage increases linked to labour market tensions will mitigate the impact of the credit crunch on consumption and housing.

- ●Saudi Arabia (4.0% after 7.0%) will benefit from its oil and a generous budget.

- ●Turkey (3.5% after 5.5%) will benefit from a strong performance in tourism, but will have to face a domestic demand dragged down by inflation and external demand impacted by the slowdown in Europe.

- ●South Africa (1.4% after 2.1%) will continue to suffer from electrical blackouts and tighter credit.

- ●Mexico (1.0% after 2.6%) will see domestic demand suffer from the cost of credit, but will be buoyed by an increase in public spending.

- ●Brazil (0.7% after 2.9%) will see increased social and infrastructure spending hit by rising rates, while excellent harvests will offset the decline in prices.

- ●In Argentina (-0.5% after 5.1%), soaring inflation, fiscal tightening, capital and import controls and drought will lead the economy into recession.

- ●In Germany (-0.2% after 1.8%), government support for businesses and consumers will marginally mitigate sluggish exports and consumption owing to inflation.

- ●France (0.3% after 2.5%) will see consumer spending undermined by inflation.

- ●While Italy (-0.6% after 3.4%) will also suffer from Germany’s poor form.

- ●Spain (1.0% after 4.7%) will be able to rely on its energy independence and tourism to alleviate weak consumer spending.

- ●In the United Kingdom (-1.0% after 4.4%), consumption, investment and construction will remain under pressure.