URD 2023

-

Presentation of the Coface Group

1.1History of the Group

COFACE SA (“the Company”) is the holding company of the Coface Group (“the Group”). It performs its activities through its primary operating subsidiary, Compagnie française d’assurance pour le commerce extérieur, and its subsidiaries. The key dates in its history are described below.

1.1.1Creation and changes to shareholding structure

Compagnie française d’assurance pour le commerce extérieur was created by decree in 1946 and established in 1948 to support French foreign trade. It is the source of the Group as it exists today. Its first shareholders – insurance companies, banks and other financial establishments – were primarily controlled by the French State. Following the privatisation of a large number of these companies in the 1980s, the French government’s indirect holdings gradually decreased.

With the privatisation of SCOR (a result of the privatisation of UAP), its major shareholder, most of the capital of Compagnie française d’assurance pour le commerce extérieur became private, but Coface continued to manage State guarantees on behalf of the French State.

Compagnie française d’assurance pour le commerce extérieur was listed on the primary market of the Paris Stock Exchange by its shareholders.

Natexis Banques Populaires, established through the acquisition by the Caisse centrale des banques populaires of Natexis, the latter resulting from the merger of the Group’s two original shareholders (Banque française du commerce extérieur and Crédit national), acquired 35.26% of the Compagnie française d’assurance pour le commerce extérieur share capital from SCOR and became its majority shareholder, owning 54.4% of the share capital.

After Compagnie française d’assurance pour le commerce extérieur was delisted from the Paris Stock Exchange in 2004, it became a wholly owned subsidiary of Natixis, the entity born out of the merger between Natexis Banques Populaires and Ixis CIB. Natixis is the financing, asset management and financial services bank of Groupe BPCE, one of the leading French banking groups, which was created by the merger of the Banques Populaires and Caisses d’Epargne in 2009.

The Company strengthened its equity through two capital increases, fully subscribed by Natixis, for €50 million and €175 million respectively, in view of maintaining the Group’s solvency margin in the sharp economic slowdown at that time.

On June 27, the Company launched an initial public offering (IPO) on Compartment A of the Euronext Paris regulated market. The offering concerned a total of 91,987,426 shares, representing 58.65% of its capital and voting rights.

The Company proceeded with two share buyback programmes, of €30 million and €15 million respectively, under the second pillar of the Fit to Win strategic plan, with the aim of improving the capital efficiency of its business model.

On June 24, the Euronext Expert Indices Committee included COFACE SA in the SBF120, the flagship index of the Paris Stock Exchange. This was thanks to the improved liquidity of Coface securities and an increase in its market capitalisation.

On February 25, Natixis announced the sale of 29.5% of the capital of COFACE SA to Arch Capital Group Ltd (“Arch”). Completion of the transaction was subject to obtaining all the required regulatory authorisations. At December 31, Natixis’ stake in the Company’s capital remained at 42.20% pending the completion of the transaction.

On October 26, the Company launched a €15 million share buyback programme. Through the Build to Lead strategic plan, Coface continues to improve the capital efficiency of its business model.

On February 10, Natixis and Arch Capital Group announced that the sale of 29.5% of COFACE SA’s shares had obtained all the necessary approvals. Following this transaction, Natixis’ stake in the Company’s capital stood at 12.7%.

On January 6, Natixis announced the sale of its remaining stake in COFACE SA. This disposal represented approximately 10.04% of COFACE SA’s share capital, or 15,078,095 shares. It was carried out by means of an accelerated bookbuild (ABB) at an average price of €11.55. As a result of this transaction, Natixis no longer holds any shares in COFACE SA.

-

1.2Presentation of the credit insurance market and the competitive environment

1.2.1Credit insurance market

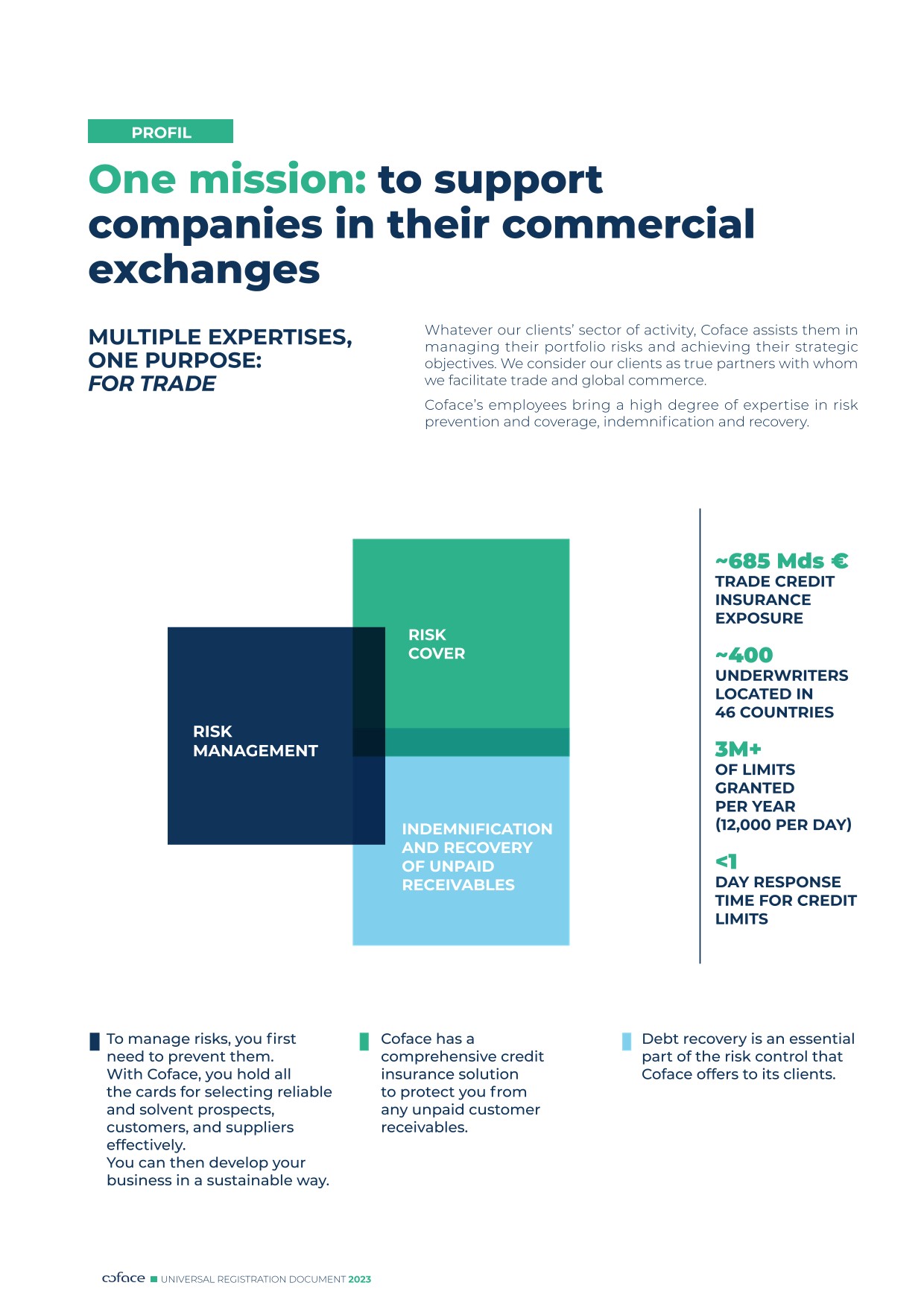

The purpose of credit insurance is to protect a company against default on payment of its trade receivables. It provides conditional insurance coverage on counterparties approved by the insurer. The solution offers two basic services: the prevention of debtor risks – by selecting and monitoring insured buyers – and the collection of unpaid receivables. In the classic form of the product, these two services are the main hallmarks of the expertise of sector players.

The Group’s principal activity concerns short-term credit insurance (defined by risks of no more than 12 months), which is a market representing around €10 billion in premiums. The Group is also active in the medium-term credit insurance market through its Single Risk offer. This is a global market which is often syndicated, with a value of some €2 billion in premiums. In 2023, the Single Risk business represented approximately 1.3% of the Group’s consolidated turnover.

The Group believes that the credit insurance sector has significant growth potential. The penetration rate of credit insurance in the overall volume of trade receivables worldwide remains low – estimated at 13% by the ICISA (1) (International Credit Insurance and Surety Association) – offering real potential for client acquisition. However, long term growth in the sector remains modest, at around 3%, and typically fluctuates between 0% (2016) and 5% (2005-2009, 2019) when driven by the global economy (2). In 2020, however, the market contracted by more than 5% due to the economic crisis caused by Covid-19. This contraction then gave way to a dynamic recovery since 2021, reinforced by the effects of inflation in 2022, when the sector recorded exceptional growth of 15%.

-

1.3Principal activities

Coface applied IFRS 17 and IFRS 9 accounting standards from January 1, 2023. All comparisons are made using the pro forma 2022 IFRS 17 figures presented on April 27, 2023.

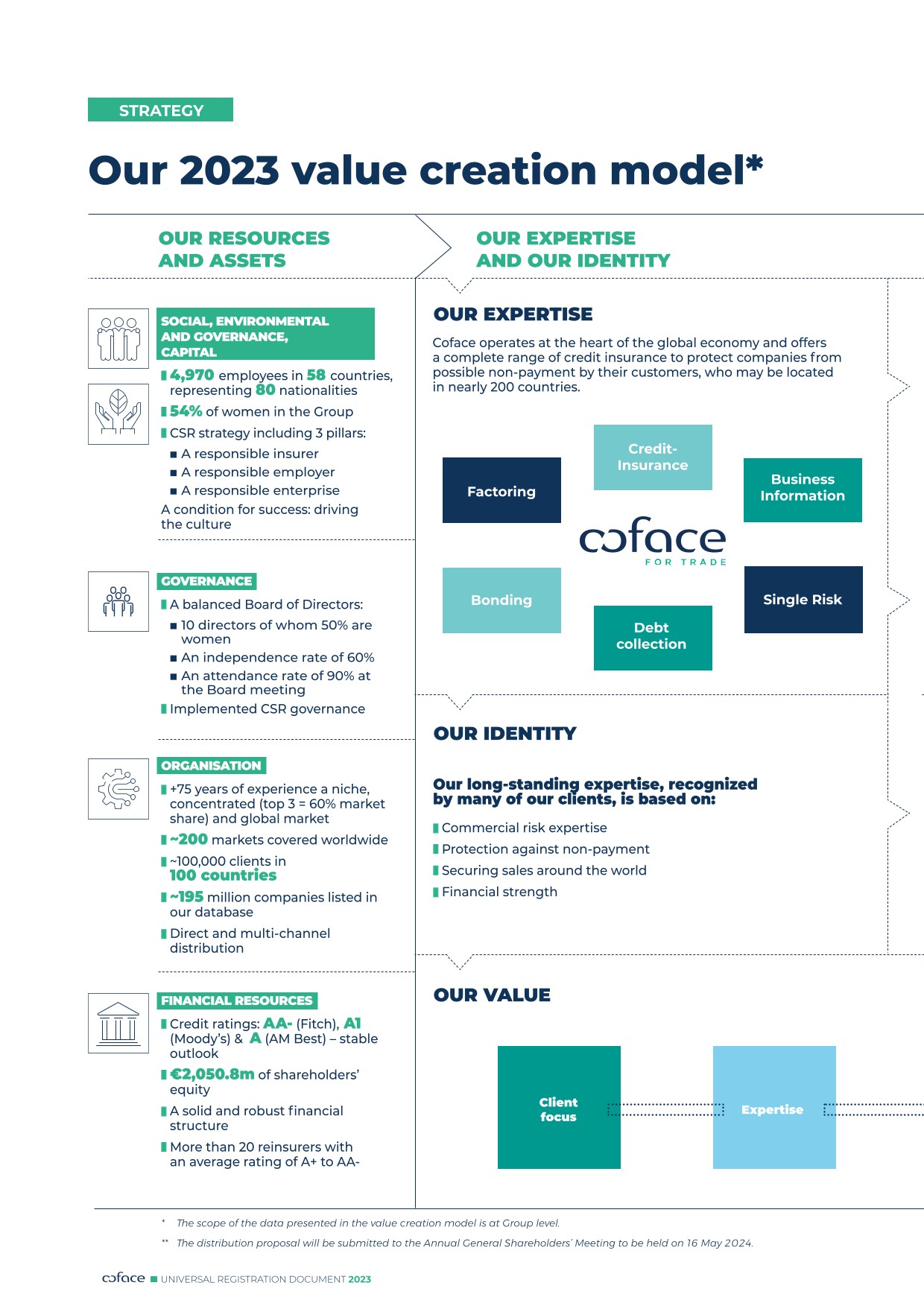

The Group’s activities are mainly focused on credit insurance, which represented 88.9% of its revenue in 2023. This entails providing businesses with solutions to protect them against the risk of client debtor insolvency in both their domestic and export markets.

The Group is also present in the factoring market, in Germany and in Poland, and in the surety bond market in Italy, France and Germany mainly. In some countries, mainly in Central Europe and Israel, the Group has historically sold business information and debt collection products. In 2020, the Group decided to modernise and deploy its information offering globally. It reviewed its product range, strengthened the sales force and upgraded its technology platform. The Group built a sales organisation adapted to the needs of the information market, enabling it to drive strong growth. The information services business thus saw its revenue grow by 17% in 2023.

The Group generates its consolidated turnover of €1,868 million from approximately 100,000 clients (1). Average annual income per client is less than €30,000 and is generated in very diversified business sectors and geographic regions.

The Group does not consider itself to be dependent on any particular policyholders. For the financial year ended December 31, 2023, the largest policyholder represented less than 1.75% of its consolidated turnover.

The following table shows the contribution of these activities to the Group’s consolidated turnover (at current FX and perimeter, restated for IFRS 17) at December 31, 2022 and 2023:

/Consolidated turnover by business line

(in thousands of euros and as a % of the Group total)

See

also SectionDec. 31, 2023

Dec. 31, 2022

(in thousands of euros)

(as a %)

(in thousands of euros)

(as a %)

Gross earned premiums – Credit

1,464,765

78.4%

1,432,845

79.6%

Gross earned premiums – Single Risk

24,644

1.3%

20,510

1.1%

Gross earned premiums – Credit insurance

1,489,409

79.7%

1,453,355

80.8%

Fee and commission income (1)

171,374

9.2%

158,574

8.8%

Other related benefits and services (2)

51

0.0%

39

0.0%

Turnover from credit insurance activity

1.3.1

1,660,834

88.9%

1,611,968

89.6%

Gross earned premiums – Bonding

1.3.3

69,654

3.7%

62,307

3.5%

Financing fees

34,688

1.9%

32,888

1.8%

Factoring fees

40,794

2.2%

41,126

2.3%

Other

(2,797)

(0.1%)

(3,600)

(0.2%)

Net income from banking activities (factoring)

1.3.2

72,686

3.9%

70,414

3.9%

Business information and other services

56,419

3.0%

48,359

2.7%

Receivables management

8,638

0.5%

5,982

0.3%

Turnover from information and other services

1.3.4

65,057

3.5%

54,341

3.0%

Consolidated turnover

1,868,231

100.0%

1,799,030

100.0%

- ( 1 )Policy management costs.

- ( 2 )IPP commission – International policies commission; business contributors’ commission.

-

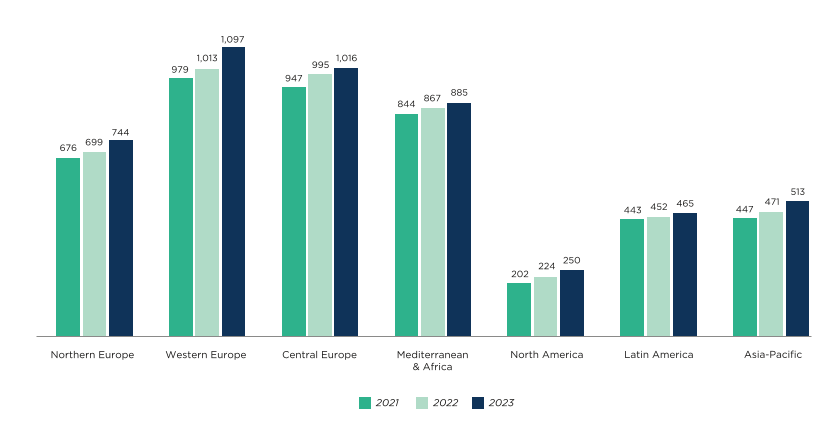

1.4Positioning of the Coface Group region by region (5)(6)

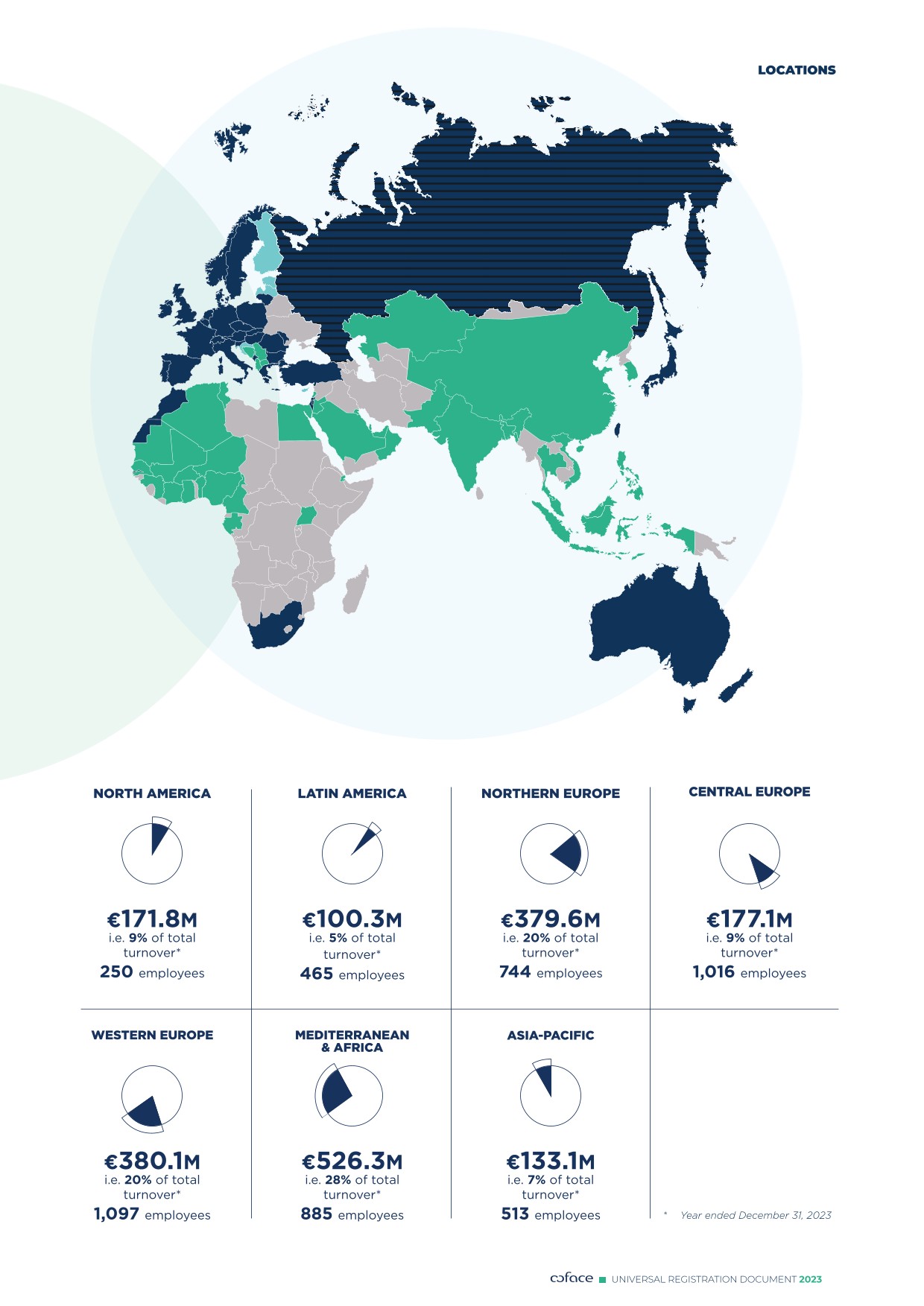

Thanks to its leading international presence, the Group organises its business lines around seven geographic regions in which it sells its products:

- ●Western Europe;

- ●Northern Europe;

- ●Central Europe;

- ●Mediterranean & Africa;

- ●North America;

- ●Latin America;

- ●Asia-Pacific.

Group activities in the Western Europe region

/Availability of the Group’s offering

Key figures

The Group, which currently employs approximately 1,097 people in the Western Europe region, generated turnover of €380.1 million in the region, or 20.3% of its total turnover for the financial year ended December 31, 2023.

Classification of countries and offering

The Group’s activities in Western Europe are heavily oriented towards the sale of credit insurance policies. However, there are also certain local features, for example the Group also sells bonding products in France and Single Risk policies in the United Kingdom and France. All countries in this region have significantly strengthened their information offering in line with the Build to Lead strategic plan.

Marketing and strategy

Western European countries are mature credit insurance markets. The offering is mainly distributed through specialised credit insurance brokers. Large brokers use their own international distribution network or third-party distribution partners, particularly for international programmes. In France, Coface rounds out its distribution network with a direct sales force across France and is diversifying its multi-channel sales approach by developing partnerships with banks.

-

1.5Group strategy

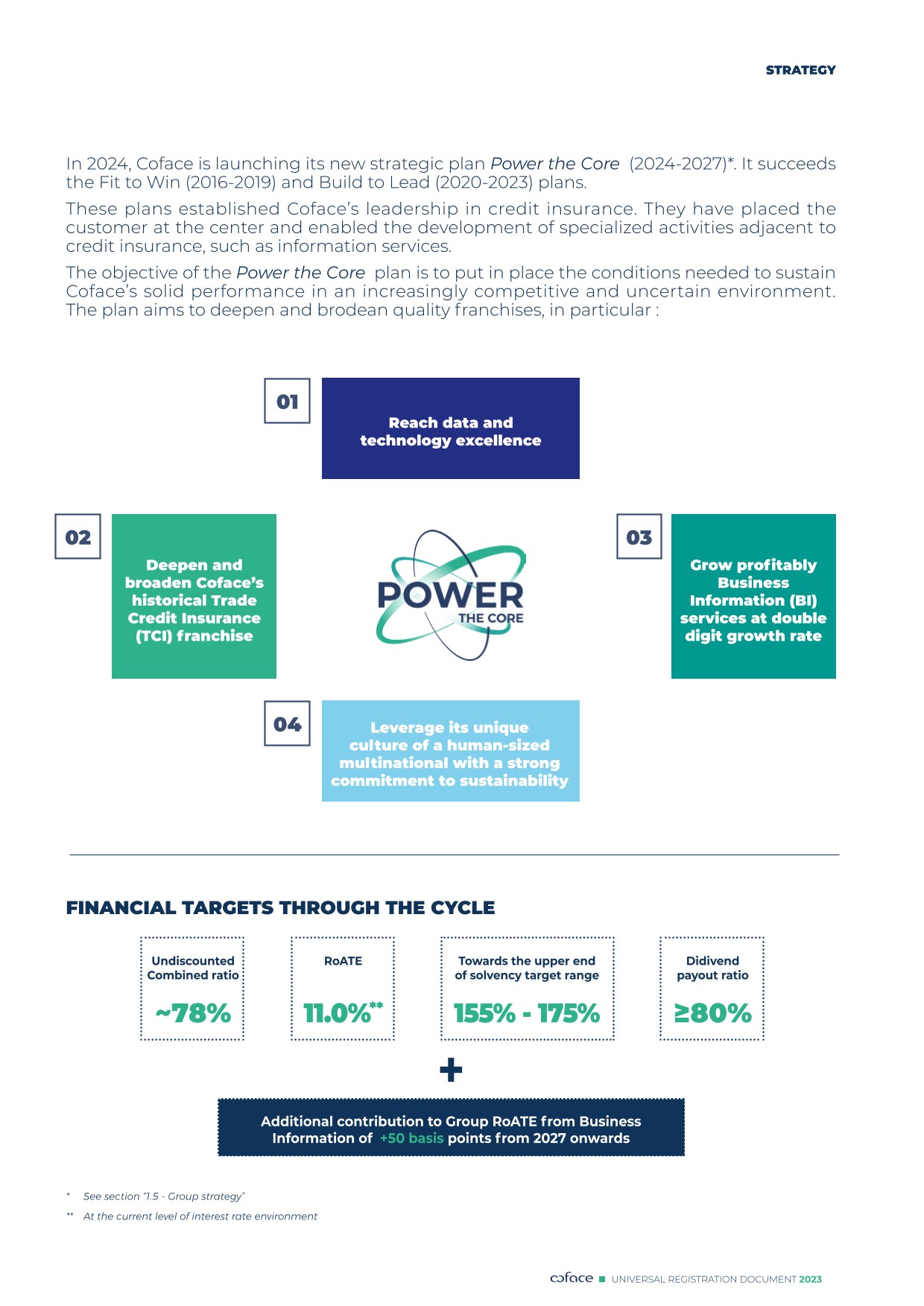

In 2024, Coface will launch its new strategic plan Power the Core for the 2024-2027 period. This plan succeeds the Fit to Win (2016-2019) and Build to Lead (2020-2023) strategic plans. These plans have strengthened Coface’s leadership in credit insurance. They placed the client at the centre of its activities and enabled the development of specialised activities adjacent to credit insurance, such as information services.

The objective of Power the Core (2024-2027) plan is to establish the conditions to sustain Coface’s robust performance in an increasingly competitive and uncertain environment. Power the Core is structured around three main pillars:

- 1 .Strengthening Coface’s leadership in credit insurance;

- 2 .Expanding the Business Information services in synergy with credit insurance;

- 3 .Investing in data, technology and connectivity to serve clients and our business lines.

The Group will also continue to manage its capital more effectively so it can secure the resources needed to finance its growth.

- ●an undiscounted combined ratio at ~78%,

- ●a return on average tangible equity (RoATE) of 11.0%, at the current level of interest rate environment,

- ●a solvency ratio towards the upper end of the 155%-175% target range,

- ●a payout ratio of at least 80% of net income,

- ●an additional contribution from Business Information services to group RoATE of 50bp starting in 2027.

1.5.1Strengthening Coface’s leadership in credit insurance

Maintain consistent, disciplined, agile and transparent risk management

Coface stands out for the quality of its underwriting and its risk management. Power the Core will strengthen fundamentals while capitalising on the opportunities offered by new technologies. Commercial underwriting processes will be fully digitalised with a single interface. This will improve teams’ efficiency and the consistency of decisions. Artificial intelligence will be used to strengthen the automation and justification of risk underwriting decisions.

Accelerate profitable growth in high-potential segments and markets

Develop multi-channel distribution for mid-caps and SMEs

Coface will differentiate its sales approach and services to adapt them to the needs of its brokers and build their loyalty. The Group will also strengthen its direct sales forces and its network of partners in high-potential countries to better target mid-caps and SMEs.

Strengthen our value proposition for international key accounts

Coface is one of the few players in the credit insurance market to offer solutions adapted to the needs of international key accounts, which are keen to develop their export activities while controlling their credit risk. With teams present in 35 countries, Coface Global Solutions (CGS) offers unique international coverage, able to issue policies in 100 countries.

The Group will continue to roll out its GlobaLiner offering, adapted to international customers. GlobaLiner will continue to improve the client experience and the adaptation of insurance policies in the 100 countries in which Coface operates worldwide.

Propose a credit insurance offer adapted to demand in certain markets

The Group will roll out a non-cancellable credit insurance offering that meets the needs of markets such as the United States and Japan. In doing so, the Group will continue to maintain its risk management discipline.

Coface will adapt its strategy to better address the under-penetrated SME segment by rolling out EasyLiner in several target countries. The subscription of EasyLiner has been made easier and is carried out on an online portal in order to remove the main obstacle to the adoption of credit insurance by SMEs.

Continue to simplify the client experience and operations

The Group will complete the simplification of its offering, which it began under the Build to Lead strategic plan, with the X-Liner range. It will deploy initiatives to commit all employees to high service quality objectives. Client retention and satisfaction will be enhanced with the transformation of key claims and contract management processes.

-

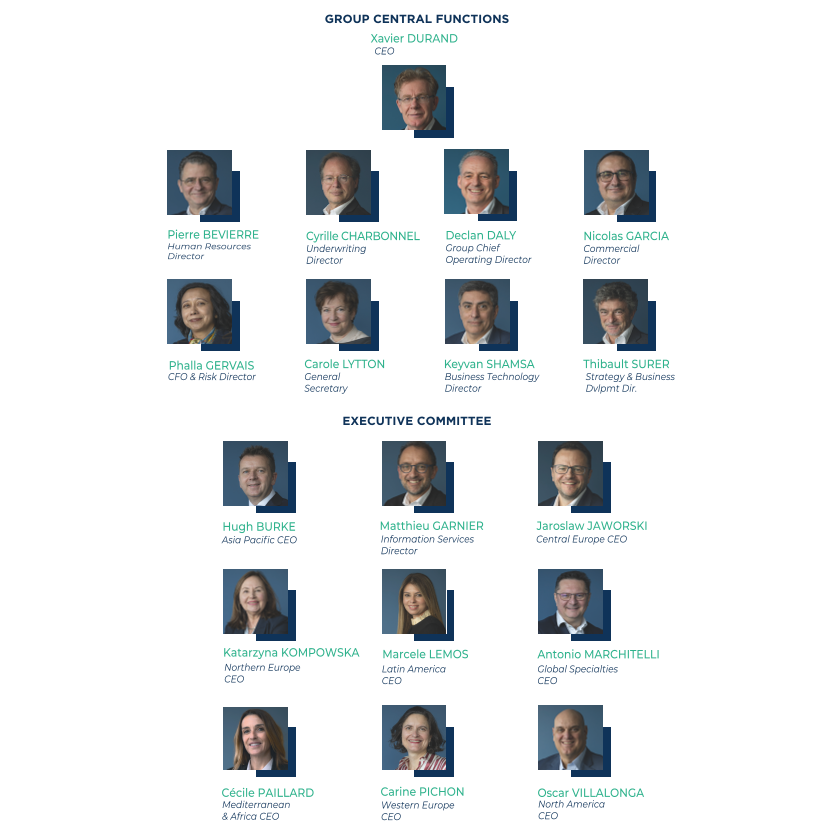

1.6Group Organisation

The Group’s organisation includes seven regions and functional departments. Each of the Group’s seven regions is headed by a regional director who is a member of the Group’s Executive Committee.

This organisation, built on clearly defined responsibilities and transparent governance, aims to facilitate the implementation of the Group’s strategic guidelines.

- ●the Strategy and Development Department, headed by Thibault Surer, to which the Strategic Planning, Marketing & Innovation, Partnerships, Economic Research, Datalab and Information teams report;

- ●the Commercial Underwriting Department, headed by Cyrille Charbonnel. This department comprises the Risk Underwriting, Claims & Collections and Recovery, and Commercial Underwriting Departments;

- ●the Commercial Department, led by Nicolas Garcia;

- ●the Audit Department, led by Nicolas Stachowiak;

- ●the Finance and Risk Department, headed by Phalla Gervais;

- ●the General Secretariat, led by Carole Lytton, which includes the Legal, Human Resources, Compliance and Communications departments;

- ●the Business Technologies Department, headed by Keyvan Shamsa;

- ●the Operations Department, headed by Declan Daly.

In the corporate functions (Risk, Actuarial, Compliance and Audit), the regional departments report to head office to ensure consistency in their strategy across the Group and that control activities are performed effectively and independently. For other functions, functional ties are organised according to the principle of a strong matrix organisational structure.

1.6.1Strategy and Development Department

- ●Strategic Planning, which is in charge of strategic planning, strategic research and the Group’s development through external growth;

- ●Marketing & Innovation, which analyses competition (market studies), determines client segmentation, defines the Group’s product and service offering and pricing, and leads the innovation/digitalisation strategy as well as projects in this area;

- ●the Partnership Department, in charge of developing and setting up new distribution and fronting agreements;

- ●Economic Research, which performs analysis and publishes macroeconomic research;

- ●the Data Lab, in charge of supporting modelling, innovation and digital transformation projects;

- ●Information, which aims to develop information services. It is tasked primarily with selecting and coordinating information providers and service centres to supply the databases used by risk underwriting teams.

-

1.7Information systems and processes

1.7.1General introduction

The use of efficient, reliable and secure information systems is a major challenge for the Group in the context of its commercial offerings; the digital experience provided to its clients through its products and services is an important development focus. It is also equally important for its management, reporting and internal control procedures, since it provides a global perspective on the Group’s activities, the completion of its strategic plans and its development, the management of its risks, and the follow-up given to internal and external audit report recommendations.

In recent years, the Group has focused on aligning its information systems with its strategic objectives, and modernising, unifying and securing its business data. This approach has continued under the new strategic plan, which affords great importance to the streamlining of processes and the automation of information systems. In accordance with its disaster recovery plan (DRP), all servers worldwide are hosted in two external data centres located in the Paris region in France, which will soon be supplemented with a third cold data storage solution. All data are backed up on a private cloud. These two sites combine the Group’s information system equipment (servers, storage, backups, network and telecommunications equipment, security, etc.). In the event of a failure at one of these two sites, the other takes over in a completely transparent manner for all users. The “information systems” component of the DRP is tested twice a year.

The Group has chosen to guarantee a high level of expertise and quality in data management, and has chosen open information systems, which allow it to keep abreast of the technological developments needed for its activities, through a range of applications consisting of internally developed applications and software packages.

Furthermore, the Group’s information systems follow a quality process based on the ITIL (Information Technology Infrastructure Library) standard. Its development teams apply agile methods and an active certification process. As such, the Coface Group’s information systems have been ISO 9001 certified since 2000 (1).

Overall, thanks to this new architecture, maintenance costs have fallen and security and the assurance of business continuity have improved. The Group is committed to investing in its information systems, particularly to support its commercial and innovation strategy, while also controlling related expenses and investments.

The information systems allow staff to work remotely. In accordance with the business continuity plan (BCP), the Group has strengthened its resources to maintain security and availability outside the Company’s premises. This period was also an opportunity for criminals to develop their activities. The Group therefore decided to strengthen its security by increasing the resources allocated to both human and technical security. Processes were reviewed to ensure that security is taken into account, existing solutions were improved, and new ones have been added. This work has already proven effective in countering these ever-increasing attacks.

-

1.8 The Group’s regulatory environment

The Group is governed by specific regulations in each of the countries in which it operates its insurance or factoring activities, either directly, or through branches, subsidiaries or partnerships. In certain jurisdictions, information sales and/or debt collection activities may also be regulated.

1.8.1Credit insurance activities

General rules on oversight and control of the Group’s activities

The French Insurance Code (Code des Assurances), notably in Book III thereof, provides that an insurance company holding an authorisation from a Member State that allows it to perform its activities in one or more classes of insurance, may exercise these same activities, directly or through branch offices, under the European passport.

As an insurance company, Compagnie française d’assurance pour le commerce extérieur is subject to the provisions of the French Insurance Code and European Union regulations, in particular Solvency II. The Company and its branches in the European Union are placed under the supervision of the Autorité de contrôle prudentiel et de résolution (ACPR), an independent administrative authority. It ensures that insurance undertakings are always able to meet their commitments to their policyholders through the application of appropriate internal policies and a sufficient level of own funds. In this respect, level two controls have been put in place since 2008. They mainly relate to:

- ●regulatory licences and authorisations;

- ●compliance with personal data protection regulations;

- ●the implementation of procedures to guarantee the confidentiality of data;

- ●governance rules;

- ●compliance with anti-money laundering and counter-terrorist financing legislation;

- ●the Know Your Customer obligations incumbent on insurance companies; and

- ●the effectiveness of reporting procedures.

The Company, as a holding company for an insurance group, is likewise subject to the ACPR’s additional oversight as concerns compliance with the solvency standards (see Section 5.2.2 “Financial Risks”).

In accordance with Articles L.322-4 and R.322-11-1 to R.322‑11-3 of the French Insurance Code, any party (acting alone or in concert) that intends to increase or decrease its interest, directly or indirectly, in the share capital of the Company or Compagnie française d’assurance pour le commerce extérieur, such that the voting rights held by that party (or parties, in the case of a disposal or extension of interest made in concert) would go above or below the threshold of one tenth, one fifth, one third or one half of the voting rights in the Company or in Compagnie française d’assurance pour le commerce extérieur, is required to inform the ACPR of such plan and obtain its approval in advance. Pursuant to Article L.561-2 of the French Monetary and Financial Code, Compagnie française d’assurance pour le commerce extérieur is subject to the legislative mechanism relating to combating money laundering and the financing of terrorism. The current mechanism, codified under Title Six, Book V of the French Monetary and Financial Code, includes oversight of any practices whereby third parties would use insurance operations to engage in corruption or to reintroduce the proceeds of criminal offences into the legal economy. Transactions likely to be the result of an act of corruption, money laundering, or terrorism financing are analysed and, where applicable, result in a suspicious transaction report to TRACFIN (the French financial intelligence unit), which is the competent authority for these matters in France.

Following the entry into force in 2017 of the French law of December 9, 2016 on transparency, anti-corruption and the modernisation of economic life, known as the Sapin II law, the Group reviewed its internal procedures in order to verify their legal and regulatory compliance.

Prudential regime for insurance companies

The prudential regime for insurance companies, which applies to the Company as an insurance group as defined in Article L.356-1 5 of the French Insurance Code, comprises two aspects which govern their operation:

The companies of the Group operating outside of the European Union are likewise subject to a prudential regime.

Financial aspect of the prudential regime for insurance companies

- ( i )Directive 2009/138/EC of the European Parliament and of the Council of November 25, 2009 on the taking-up and pursuit of the business of Insurance and Reinsurance, transposed by order and decree into the French Insurance Code in April and May 2015; and

- ( ii )its implementing texts, including the delegated regulations of the European Commission (“the Commission”), in particular Delegated Regulation (EU) 2015/35 supplementing the aforementioned directive, entered into force on January 1, 2016 (together, “Solvency II”).

The aim of Solvency II is, in particular, to achieve better understanding of insurers’ risks, and create a common system for all European Union members (see Section 5.2.2 “Financial risks”).

- ●the valuation of assets and liabilities;

- ●technical provisions;

- ●own funds;

- ●the solvency capital requirement;

- ●the minimum capital requirement; and

- ●the investment rules that must be applied by insurance companies.

In this regard, the insurance entities located in the European Union are branches of the Company. This makes it possible to pool all these entities’ assets and to leave only the minimum amount of cash required for operational requirements at the local level.

In other countries, regardless of the legal status of the entity concerned, the Group must comply with local regulations. To that end, the entities hold their asset portfolios and their cash locally in order to meet the asset-liability and solvency requirements set by local regulators.

Accounting aspect of the prudential regime for insurance companies

In addition to the general accounting obligations enacted by Articles L.123-12 et seq. of the French Commercial Code, the Group is subject to specific accounting rules for insurance companies, which have been codified under Title IV, Book III of the French Insurance Code. In fact, the inversion of the production cycle that is specific to insurance activities, i.e. the fact of providing services with an actual cost that will only be known after the fact, justifies the existence of specific accounting rules for the companies that conduct these activities.

The Group’s consolidated financial statements are prepared in accordance with IFRS rules including the revised IFRS 17, applicable from January 1, 2023. IFRS 17 Insurance Contracts is an international financial reporting standard for the insurance sector that aims to harmonise the measurement of insurance contracts between countries, make their accounting presentation more transparent and ensuring consistency with other IFRSs. Alongside the application of this standard, IFRS 9 on financial instruments traded on spot or derivatives markets has also applied to insurance holding companies since January 1, 2023. The Group has thus adopted the French principles to show the accounting of the insurance contracts.

Regulations applicable to credit insurance policies signed by the Group

The policies issued in each of the countries where it is present comply with the corresponding country’s regulations. In France, credit insurance policies issued by Coface are not subject to the provisions of the French Insurance Code, but rather to those of the general law on contracts – with the exception of the provisions of Article L.111-6 (major risks), L.112-2 (pre-contractual information), L.112-4 (content of insurance policies), L.112-7 (information to be provided when the contract is offered under European freedom to provide services provisions) and L.113-4-1 (reasons to be provided to the policyholder by the credit insurer when coverage is terminated) of the French Insurance Code.

-

Corporate governance

2.1Structure and Operation of the Board of Directors and its specialised Committees

2.1.1Details of the members of the Board of Directors for financial year 2023(1)

The information and biographies presented below were drawn up as at December 31, 2023. The Board of Directors of COFACE SA is composed of ten directors, with a majority of independent directors (six members), including the Chairman, as well as four directors appointed by Arch Capital.

Name

Personal information

Experience

Position on the Board of Directors

Age

Gender

Nationality

Number of shares

Number of offices

held in listed companies (1)Inde-

pendent

Start of term/

End of termAttendance rate (2)

Board Committees/

Attendance rate (3)Bernardo Sanchez Incera

63

Spanish

1,000

1

✓

Feb. 10, 2021

2024 AGM

100%

NCC

100%

Janice Englesbe

55

American

1,000

-

Feb. 10, 2021

2024 AGM

100%

RC

100%

David Gansberg

51

American

1,000

-

Jul. 28, 2021

2024 AGM

78%

AAC

100%

Chris Hovey

57

American

1,000

-

Feb. 10, 2021

2024 AGM

67%

-

Isabelle Laforgue

43

French

1,000

-

✓

Jul. 27, 2017

2024 AGM

100%

AAC -100%

RC -100%

Laetitia

Léonard-Reuter48

French

1,000

-

✓

May 17, 2022

2025 AGM

100%

AAC (Ch.)

100%

Nathalie Lomon

52

French

1,000

1

✓

Jul. 27, 2017

2024 AGM

89%

RC (Ch.)

100%

Sharon MacBeath

54

British

1,000

-

✓

Jul. 1, 2014

2025 AGM

89%

NCC (Ch.)

100%

Laurent Musy

57

French

1,400

-

✓

May 17, 2022

2025 AGM

89%

RC -100%

Nicolas Papadopoulo

61

French

12,800

-

Feb. 10, 2021

2024 AGM

89%

NCC -100%

Average (4)

54

50% (5)

50%

60%

90%

For the purposes of their corporate offices, the members of the Board of Directors are domiciled at the head office of the Company.

- ( 1 )With the exception of the office held within the Company.

- ( 2 )Average attendance rate at Board meetings.

- ( 3 )AAC: Audit and Accounts Committee – RC: Risk Committee – NCC: Nominations, Compensation and CSR Committee – Ch.: Chairman

- ( 4 )Average at December 31, 2023

- ( 5 )Percentage of women on December 31, 2023

Female

Male

Changes in the composition of the Board of Directors and the Board Committees since the beginning of 2023

-

2.2Chief Executive Officer and Group General Management Committees

At the meeting of November 22, 2012, the Board of Directors decided to separate the roles of Chairman of the Board of Directors and Chief Executive Officer. This decision reflects the Company’s wish to comply with best practices in corporate governance and to clearly distinguish between the strategic, decision-making and supervisory duties of the Board of Directors, and the operational and executive duties of the Chief Executive Officer. This separation was expressly reiterated by the Board of Directors at its meeting of January 15, 2016 on the appointment of Xavier Durand and on his reappointment at the meetings held on February 5, 2020 and February 27, 2024.

2.2.1Experience and offices of the Chief Executive Officer

For the purposes of this Universal Registration Document, the Chief Executive Officer is domiciled at the Company’s head office.

Xavier DURAND

AGE: 59

EXPIRATION DATE OF

THE TERM OF OFFICE:

Ordinary Shareholders’ Meeting

called to approve the financial

statements for the financial

year ended December 31, 2023339,500 shares (255,000 in registered

form and 84,500 bearer shares)(voir le paragraphe 7.2.9 « Transactions effectuées par les personnes exerçant des responsabilités dirigeantes »)

Chief Executive Officer

since February 9, 2016

Curriculum Vitae

Xavier Durand is a graduate of the École Polytechnique and the École Nationale des Ponts et Chaussées. He started his career in 1987 with consultancy firm The Mac Group (Gemini Consulting) before joining Banque Sovac Immobilier in 1994 as deputy CEO. In 1996, Xavier Durand joined GE Capital, where he led an international career, first in Chicago as Director of Strategy and Growth in the finance division of the Global Auto business, then in France, first as CEO of GE Money Bank France, then CEO for Europe of GE Money and GE Capital’s banking activities. In 2011, he was named CEO of GE Capital Asia-Pacific, based in Japan. He was appointed GE Capital’s Director of Strategy and Growth, based in London, at the end of 2013. He has been Chief Executive Officer of COFACE SA since February 9, 2016.

Principal terms of office and duties

During financial year 2023

- ●Chairman of the Board of Directors and Chief Executive Officer of Compagnie française d’assurance pour le commerce extérieur

- ●Chairman of the Board of Directors of Coface North America Holding Company

- ●Director of Ayvens (1) (formerly ALD Automotive), Chairman of the Risk Committee (since June 2023) and member of the Audit Committee

During the past five years and which are no longer held

- ●N/A

-

2.3Compensation and Benefits paid to managers and corporate officers

The Company refers to the AFEP-MEDEF Code to prepare the report required by Article L.225-37 of the French Commercial Code.

The tables in the sections below present a summary of the compensation and benefits of any kind paid to the Company’s executive directors and members of the Company’s Board of Directors by:

- ( i )the Company;

- ( ii )companies controlled by the Company in which the office is held, within the meaning of Article L.233-16 of the French Commercial Code;

- ( iii )companies controlled by the Company or companies that control the Company in which the office is held, within the meaning of Article L.233-16 of the French Commercial Code; and

- ( iv )the Company or companies that control the Company in which the mandate is exercised, within the meaning of the same article.

Since the Company belongs to a group at the date of this Universal Registration Document, the information concerns the amounts owed by all companies in the chain of control.

The Company is a limited corporation (société anonyme) with a Board of Directors. The duties of Board Chairman, performed by Bernardo Sanchez Incera since February 10, 2021, and Chief Executive Officer, performed by Xavier Durand, have been separated.

Xavier Durand is compensated by the Company for his functions as Chief Executive Officer as described in Sections 2.3.2 and 2.3.3 below.

2.3.1Employee compensation policy

Regulatory framework

The Company’s compensation policy is in line with the provisions of Directive 2009/138/EC of the European Parliament and of the Council of November 25, 2009 on the taking-up and pursuit of the business of Insurance and Reinsurance (Solvency II) and Delegated Regulation (EU) 2015/35 of the European Commission of October 10, 2014 (Article 258(1), point 1 and Article 275).

Generally speaking, compensation practices should contribute to effective risk management at the Company, and in particular:

- ●ensure strict compliance with the laws and regulations applicable to insurance companies;

- ●prevent conflicts of interest and not encourage risk-taking beyond the limits of the Company’s risk tolerance;

- ●be consistent with the Company’s strategy, interests and long-term results;

- ●guarantee the Company’s capacity to keep an appropriate level of own funds.

In this context, Coface’s compensation policy specifies general provisions applicable to all employees according to certain criteria and provisions specific to regulated categories of employees in the definition of the Solvency II Directive.

General principles

The compensation policy is a key instrument in implementing Coface’s strategy. It seeks to attract, motivate and retain the best talent. It encourages individual and collective performance and seeks to be competitive in the market while respecting the Group’s financial balance. It complies with the regulations in force, guarantees internal equity and professional equality, particularly between men and women. It incorporates social and environmental issues.

It is proposed by the Group HR Department and is reviewed by the Nominations, Compensation and CSR Committee, and then subject to approval by the Board of Directors. The HR function is responsible for implementing the policy at the local to ensure practices are consistent within the Group, and to ensure each country is compliant with local regulations and remains competitive in the market.

Structured in a clear and transparent manner, compensation is intended to be adapted to the Group’s objectives and to assist it in its long term development strategy:

- ●fixed compensation: this is the principal component of individual compensation and depends on the skills and expertise expected for a given position. It is set at the time of hiring and reviewed annually in light of market practices, individual contribution and internal equity in strict compliance with the budgets allocated for the financial year;

- ●annual individual variable compensation (“bonus”): the Group’s variable compensation policy takes into account individual and collective performance over a given year and is assessed on the basis of financial and non-financial criteria. The eligibility rules and variable compensation level are set by function, responsibility level and market under consideration;

- ●For the Group’s Senior Managers (Top 200), the target variable compensation is set as a percentage of the base salary and may not exceed 100% of this. Variable compensation is awarded based on objectives set annually by the Management Board and the managers of each function, with the support of the Group’s HR Department. This procedure ensures that individual objectives are consistent with the Company’s strategic objectives:

- ●for front office functions:

- ●quantitative objectives linked to the financial performance of the entity carrying out the activity represent 20%,

- ●objectives linked to the performance of the function in question, most of which are quantitative, represent 50%,

- ●30% of objectives are set individually at the annual performance review. These may be quantitative and/or qualitative objectives, provided that they comply with SMART rules (specific, measurable, attainable, relevant and time-bound),

- ●For the control and support functions, the quantitative objectives linked to the financial performance of the operating entity account for 20%, and targets set individually for 80% of the total,

- Furthermore, to avoid any conflict of interest, for the control functions referred to in Articles 269 to 272 (audit, risk, compliance), the collective part of annual variable compensation based on financial objectives is assessed based on the Group scope, irrespective of the employee’s level of involvement, to prevent them from being directly assessed on the performance of the units placed under their control;

- ●for front office functions:

- ●Long-Term Incentive Plan: since 2016, the Group has awarded performance shares to two types of employees each year:

- ●employees identified under the Solvency II Directive, which imposes a system for deferred total variable compensation. This category includes members of the Executive Committee, key functions and employees having a significant impact on the Company’s risk profile,

- ●key employees as part of a reward and retention process.

This plan also ensures that the interests of the beneficiaries are aligned with those of the shareholders over the long term.

- ●collective variable compensation (employee savings): in France, the Group negotiated a three-year profit-sharing agreement in 2021. This agreement benefits all employees on permanent and fixed-term employment contracts, who have more than three months’ seniority within the companies forming part of the Compagnie française d’assurance pour le commerce extérieur – Fimipar economic and corporate unit (a wholly-owned subsidiary of the Group). Participation is defined according to the legal formula. Similar collective schemes exist in other Group entities depending on their legal obligations with a view to giving employees a stake in the Company’s performance;

- ●employee benefits: Employee benefits are determined locally. The Group ensures consistency of practices and guarantees a level of social protection that is competitive in the market and respectful of its employees. All members of the Executive Committee have a supplementary pension plan.

In 2020, the Group implemented a car policy aimed at harmonising practices and reducing the carbon impact of its vehicle fleet. It is gradually replacing its high-emission vehicles with petrol, hybrid or 100% electric vehicles.

The compensation of employees consists, in whole or in part, of these elements, depending on the position held, the level of responsibility and the reference market.

Special provisions applicable to Solvency II regulated categories of employees

Scope of regulated categories of employees

Pursuant to the provisions of Article 275, Section 1, Point (c) of Regulation 2015/35, Coface has identified the following functions as falling within the scope of regulated categories of employees:

- ●members of the Executive Committee including general management, the finance and risk, strategy, operations, specialised product lines, business technology functions, the General Secretariat (legal, compliance, human resources and communications), human resources, sales, risk underwriting, information, claims & recovery and collection, and regional managers;

- ●employees holding the key functions described in Articles 269 to 272 of Regulation 2015/35: audit, risk, and actuarial (the compliance key function is under the authority of the General Secretariat);

- ●employees whose professional activity has a material impact on the Company’s risk profile: compliance, risk underwriting, commercial underwriting, credit risk support, investment, reinsurance, economic research, financial communication, country managers where turnover exceeds a threshold of the Company’s total turnover determined each year.

In 2023, 32 employees fell within the regulated category. The Nominations, Compensation and CSR Committee reviews these functions, then presents them to the Board of Directors for approval. This list is reviewed each year in order to guarantee a perfect match between the evolution of the Company’s risk profile and the identification of employees.

Specific provisions regarding compensation

The Group endeavours to ensure that the proportion and structure of variable compensation are balanced and that the goals set are in accordance with the Company’s strategy and risk profile.

In addition to rules common to all employees, the Group established specific compensation rules designed for the regulated categories of employees:

- ●The variable compensation package includes the annual variable compensation (bonus) and long term variable compensation (Long-Term Incentive Plan) in the form of free performance shares. Performance shares constitute the deferred component of total variable compensation and account for at least 30% of the total amount (1). They are contingent upon presence and performance conditions and have a vesting period of three years;

- ●All risk hedging transactions are prohibited.

-

Comment on the

financial year1)Group estimates3.1Economic environment (1)

2024, a pivotal year

After a somewhat turbulent 2023, which ultimately turned out much better than expected, 2024 is shaping up to be as decisive as it is uncertain. As geopolitical tensions intensify internationally, against a backdrop of ever-worsening antagonisms and strategic rivalries, no fewer than 60 national elections - presidential and/or legislative - will shape the year, in a political and social environment that is unsettled to say the least.

In this context, the macroeconomic equation has clearly become a derivative of (geo)political balances. Consequently, our central scenario, which remains that of a prolonged but still soft landing for the global economy (+2.2% after +2.6% in 2023), is more akin to a ridge than a boulevard. There are many associated risks, some of them vertiginously bearish. After ending the year with a bang, the financial markets, still convinced that disinflation can be completely immaculate, have gradually come to their senses. Without even mentioning the disruption of value chains, brought to the fore by the strikes in the Red Sea, or the ever-increasing risk of the Middle East conflict spreading, there is no guarantee at present that the battle against inflation has been won. Neither in the long-term, of course, nor even in the short-term, despite the ongoing slowdown in the global economy. With core inflation still twice the central bank target in most developed monetary areas, the challenge for 2024 will be to see whether the monetary tightening that has been underway for over 18 months is enough to go the “last mile” and bring inflation back to 2%. And to keep it there.

Regardless, and barring an accident of course, the interest rate environment to which all agents - households, businesses, and governments - have become accustomed over the last fifteen years is now firmly in the past. While the volume of debt to be refinanced will gradually increase, there is every reason to believe that the pivot of monetary policy will not be pivotal in terms of claims, and that the upward trend in insolvencies that we have witnessed for over a year will continue. This remains the main endogenous risk to our central scenario: that the virtuous circle that has hitherto combined low insolvencies, a resilient labour market and household dissaving will be replaced by a vicious circle combining accelerating insolvencies, rising unemployment, a marked slowdown in wages and, in this context, a rise in household savings. This ultimately would have an even greater impact on demand, despite the fall in inflation.

In the framework of our central scenario, we have adjusted 13 country assessments (12 upgrades and 1 downgrade) and 22 sector assessments (17 upgrades and 5 downgrades), reflecting a significant improvement in the outlook, albeit fragile, in an environment that remains highly unstable and therefore uncertain.

-

3.2Significant events of 2023

3.2.1Acquisition of North America data analytics boutique Rel8ed

-

3.3Comments on the results as at December 31, 2023

3.3.1Group performance

Coface applied IFRS 17 and IFRS 9 accounting standards from January 1, 2023. All comparisons are made with 2022 figures adjusted for the new accounting standard IFRS 17, as presented on April 27, 2023

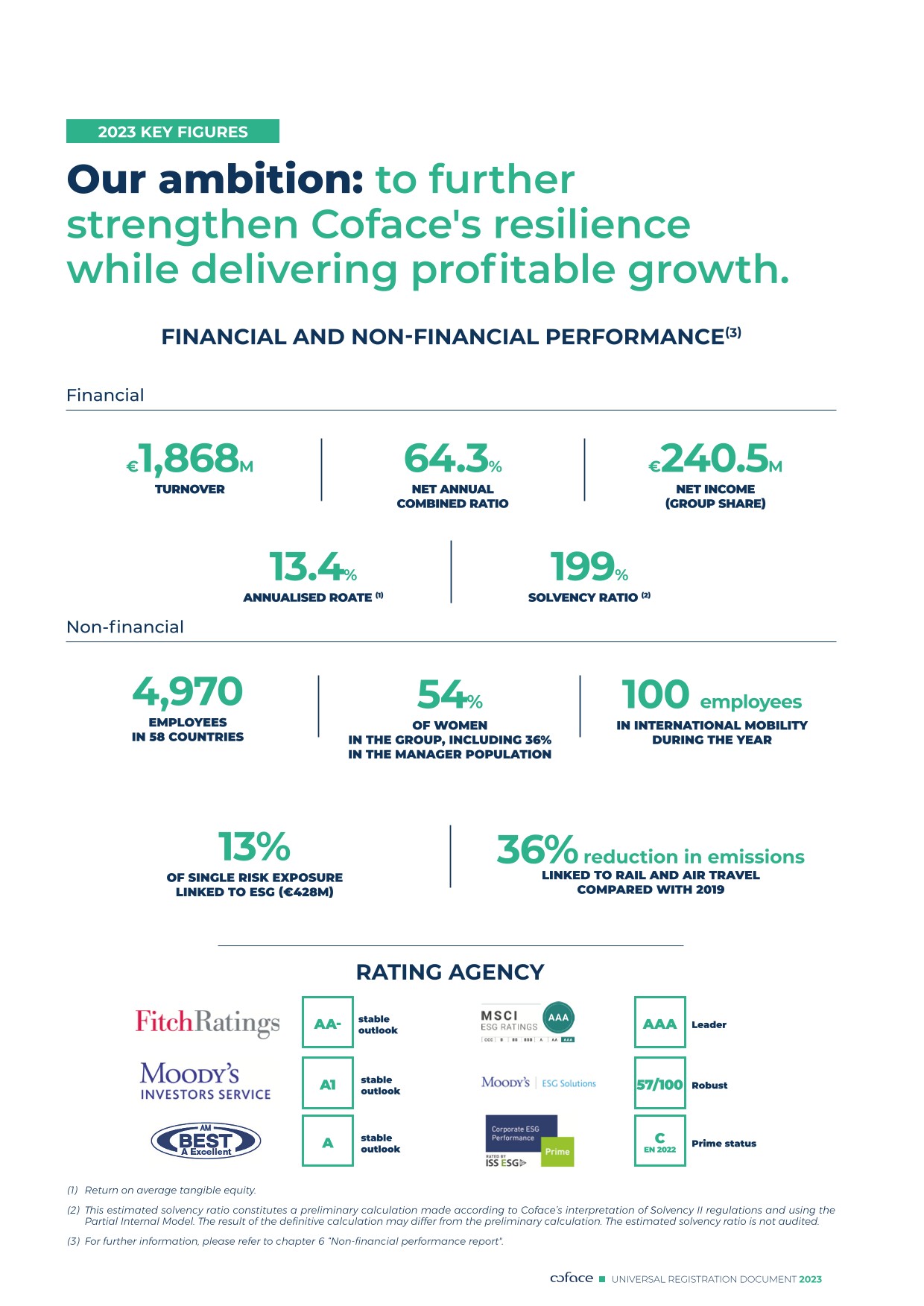

Consolidated turnover amounted to €1,868.2 million, up 6.0% on 2022 at constant FX and perimeter. The net combined ratio stood at 64.3%, or 3.3 points above the level recorded in 2022 (67.6%). This breaks down into 2.0 points decrease in the loss ratio to 37.7% and a 1.3 point decline in the cost ratio to 26.6% in relation to 2022. The Group ended the year with net income (Group share) of €240.5 million (vs. €240.4 million in 2022) and return on equity of 13.4%.

The target solvency ratio range is between 155% and 175%. The solvency ratio is estimated at 198.54% (1) at December 31, 2023. Coface will propose the payment of a dividend (2) of €1.30 per share to shareholders, representing a payout ratio of 81%.

-

3.4Group cash and capital resources

Information in this section is derived from the statement of cash flows in the consolidated financial statements and from Note 8 “Cash and cash equivalents” in the Company’s consolidated financial statements.

(in millions of euros)

As at Dec. 31

2023

2022

Net cash flows generated from operating activities

290.7

455.9

Net cash flows generated from investment activities

(327.8)

(119.8)

Net cash flows generated from financing activities

17.5

(139.9)

Effect of exchange rate changes on cash and cash equivalents

(38.6)

(4.9)

3.4.1Coface Group debt and sources of financing

The Group’s debt comprises financial debt (financing liabilities) and operating debt linked to its factoring activities (composed of “Amounts due to banking sector companies” and “Debt securities”).

Financial debt

For the year ended December 31, 2023, the Group’s financing liabilities, totalling €831.7 million, comprised two subordinated borrowings.

- ●A fixed-rate issue (4.125%) of subordinated notes carried out by COFACE SA on March 27, 2014 for a nominal amount of €380 million, maturing on March 27, 2024.

- The securities are irrevocably and unconditionally guaranteed on a subordinated basis by Compagnie française d’assurance pour le commerce extérieur, the Group’s main operating entity.

- COFACE SA redeemed €153 million of the subordinated bonds issued in 2014 at a fixed price of 103.625% on September 21, 2022.

- The nominal amount after this redemption stands at €227 million, still maturing on March 27, 2024;

- ●A fixed-rate issue (at 6.000%) of subordinated notes by COFACE SA on September 22, 2022, for a nominal amount of €300 million, maturing on September 22, 2032;

- ●A fixed-rate issue (at 5.750%) of subordinated notes by COFACE on November 28, 2023, for a nominal amount of €300 million, maturing on November 28, 2033.

The amounts raised through this issue will mainly be used to refinance the subordinated notes maturing on March 27, 2024.

Operating debt linked to the factoring business

This debt, which includes the “Amounts due to banking sector companies” and “Debt securities” items, provides refinancing for the Group’s factoring companies (Coface Finanz in Germany and Coface Poland Factoring in Poland).

Amounts due to banking sector companies, which correspond to drawdowns on the bilateral credit lines set up with various banking partners of Coface Finanz and Coface Poland Factoring and the Group’s local banks (see “Bilateral credit lines” below), amounted to €762.9 million for the financial year ended on December 31, 2023.

Debt securities amounted to €1,655.7 million for the financial year ended on December 31, 2023, including:

- ●senior units issued by the VEGA securitisation fund under the Coface Finanz factoring receivables securitisation programme (see “Securitisation programme” below), in the amount of €1,015.2 million; and

- ●commercial paper issued by COFACE SA (see “Commercial paper programme” below) to finance the activity of Coface Finanz in the amount of €640.5 million.

Coface Group’s main sources of operational financing

- ●A securitisation programme to refinance its factoring receivables for a maximum amount of €1,300 million;

- ●A commercial paper programme for a maximum amount of €700 million; and

- ●Bilateral credit lines for a maximum total amount of €1,787.3 million.

In 2023, the securitisation programme was increased to €1,300 million and the senior 1-year and senior 3-year units were renewed in December. The first option to extend Coface Poland Factoring’s multi-currency syndicated loan was exercised in August. This €310 million loan has an initial maturity of two years with two options for a one-year extension, at the lenders’ discretion. In May, the option to extend the fifth year of the syndicated loan serving as a back-up to COFACE SA’s €700 million commercial paper programme was exercised.

At December 31, 2023, Coface Group’s debt linked to its factoring activities amounted to €2,419 million.

a) Securitisation programme

To refinance its factoring activities, in February 2012 the Group set up a securitisation programme for its factoring trade receivables, guaranteed by Compagnie française d’assurance pour le commerce extérieur. In December 2023, the securitisation programme was renewed and its maximum amount was increased to €1,300 million.

This securitisation programme includes a number of standard acceleration clauses associated with such a programme, concerning the financial position of Coface Finanz (the ceding company) and other Group entities (including certain indicators regarding the quality of the ceded receivables), and linked to the occurrence of various events, such as:

- ●payment default of Coface Finanz or of Compagnie française d’assurance pour le commerce extérieur for any sum due under the securitisation fund;

- ●the cross default of any Group entity pertaining to debt above €100 million;

- ●closure of the asset-backed commercial paper market for a consecutive period of 180 days;

- ●winding-up proceedings concerning Coface Finanz, Coface Poland Factoring, the Company or Compagnie française d’assurance pour le commerce extérieur;

- ●the discontinuance of or substantial change to the activities practised by Coface Finanz or by Compagnie française d’assurance pour le commerce extérieur;

- ●a downgrading of the financial rating of Compagnie française d’assurance pour le commerce extérieur to below BBB- for the main funding line (maximum amount of €1,300 million);

- ●non-compliance with one of the covenants linked to the quality of the portfolio of ceded factoring receivables.

The securitisation programme does not contain a change of control clause for the Company, but contains restrictions regarding a change of control in Compagnie française d’assurance pour le commerce extérieur and the factoring companies resulting in their exit from the Group.

Covenant

Definition

Trigger threshold

Default ratio

Three-month moving average of the rate of unpaid receivables beyond 60 days after their due date

> 2.24%

Delinquency ratio

Three-month moving average of the rate of unpaid receivables beyond 30 days after their due date

> 5.21%

Dilution ratio

Three-month moving average of the dilution ratio

> 9.71%

b) Bilateral credit lines

To refinance its factoring business, the Group also set up a number of bilateral credit lines and overdraft facilities, mainly through its subsidiaries, for a total maximum amount of €1,787.3 million:

- ●bilateral credit lines and overdraft facilities with local banks for a maximum of €745.1 million, of which €56.6 million had been drawn in Germany and €14.5 million in Poland at December 31, 2023;

- ●bilateral credit lines concluded with banks:

- ●six lines for a maximum total amount of €475 million for Coface Finanz (with maturities ranging between one and three years), of which €241.3 million had been drawn down as of December 31, 2023,

- ●five lines (including a syndicated loan) for a maximum total amount of €667.2 million for Coface Poland Factoring (with maturities ranging between one and three years), of which €463.8 million had been drawn down as of December 31, 2023.

c) Commercial paper programme

The Group has a €700 million commercial paper issuance programme under which the Company regularly issues securities with due dates ranging generally between one and six months. At December 31, 2023, securities issued under the commercial paper programme totalled €640.5 million. The programme was rated P-2 by Moody’s and F1 by Fitch.

Should the commercial paper market shut down, since July 28, 2017 the Group has had a currently unused syndicated loan covering the maximum amount of the commercial paper issue programme (€700 million since August 2021). The agreement regulating this syndicated loan contains the usual restrictive clauses (such as a negative pledge clause, prohibition from assigning the assets outside the Group above a specified threshold or restrictions related to the discontinuance or any substantial change in the Group’s business activities) and early repayment clauses (payment default, cross default, non-compliance with representations, warranties and commitments, significant adverse change affecting the Company and its capacity to meet its obligations under these bilateral credit lines, insolvency and winding-up proceedings), in line with market practices. This syndicated loan was renewed in August 2021 for three years with two possibilities for an extension of one year each, which were exercised in 2022 and 2023.

-

3.6Outlook for the Group

The most pessimistic scenarios for 2023 did not materialise. While the Chinese economy continued to disappoint, the United States continued to surprise on the upside. The economic impact of higher interest rates was delayed in an environment of full employment and still strong corporate balance sheets.

The most notable point of the year was the generalised decline in inflation through the second half of the year due to proactive coordinated actions of central banks and the fall of energy prices despite an increasingly tense geopolitical environment.

For 2024, Coface anticipates a drawn-out soft landing for the global economy, with growth expected at +2.2% after +2.6% in 2023. Downside risks are real, in particular due to the unprecedented number of political elections in the world, culminating with the US presidential election at the end of the year.

As expected, business failures continued to rise, sometimes above pre-pandemic levels. However, the many preventive measures taken by Coface so far avoided a spike in recorded claims. While the number of claims has not yet reached 2019 levels, the total claims amount is now equivalent.

In 2023, Coface’s IFRS 17 results were stable against the previous year, once again demonstrating Coface’s resilience in a challenging environment. This year marks the end of the Build to Lead strategic plan, with all its objectives having been met or exceeded. Coface will present its new strategic plan Power the Core (2024 - 2027), which will build on the success of the Build to Lead plan, on 5 March 2024.

-

3.7Appendix - Key financial performance indicators

3.7.1.Financial indicators

Consolidated turnover

The composition of the Group’s consolidated turnover (premiums, other revenue) is described under “Accounting principles and methods” in the notes to the consolidated financial statements.

Claims expenses

“Claims expenses” correspond to claims paid under credit insurance contracts, Single Risk policies and bonding, less changes in recoveries following recourse (amounts recovered from the debtor after paying the policyholder for the claim) during the financial year, and to the change in claims provisions during the financial year, and the handling expenses for these claims, which cover the costs of processing and managing policyholders’ claims declarations, and those generated by monitoring recovery procedures (charges and provisions for internal and external debt collection fees).

Claims paid correspond to compensation paid under the policies during the financial year, net of collections received, plus costs incurred to ensure their management, regardless of the financial year during which the claim was declared or during which the event producing the claim took place, less amounts recovered during the financial year for claims previously indemnified, regardless of the year the indemnification was paid.

Claims provisions are established for claims reported but not yet settled at financial year end, as well as for claims that have not yet been reported, but which have been deemed probable by the Group, given the events that have arisen during the financial year (incurred but not reported (IBNR) provisions). The amounts thus provisioned also take into consideration a forecast of the amount to be collected for these claims. These provisions are decreased each year by reversals made following the payment of compensation or the estimate of potential losses for reported or potential claims. The difference between the amount of provisions in a given financial year (established during the first year of underwriting a policy) and the amounts revalued the following years is either a liquidation profit (revaluation downward) or loss (upwards revaluation) (see Note 23 to the consolidated financial statements).

Operating expenses

- ●“Contract acquisition costs”, consisting of:

- ●external acquisition costs, namely commissions paid to business contributors (brokers or other intermediaries) and which are based on the turnover contributed by such intermediaries,

- ●and internal acquisition costs, which are essentially fixed costs related to payroll expenses for contract acquisition and the costs of the Group’s sales network;

- ●“Administration costs” (including Group operating costs, payroll costs, IT costs, etc., excluding employee profit sharing and incentive schemes). Contract acquisition costs as well as administration costs primarily include costs linked to the credit insurance business. However, due to pooling, costs related to the Group’s other businesses are also included in these items;

- ●“Other current operating expenses” (expenses that cannot be allocated to any of the functions defined by the chart of accounts, including in particular general management expenses);

- ●“Expenses from banking activities” (general operating expenses, such as payroll costs, IT costs, etc. relating to factoring activities); and

- ●“Expenses from other activities” (overheads related exclusively to information and debt collection for customers without credit insurance).

As such, “Operating expenses” consist of all overheads, with the exception of internal investment management expenses for insurance - which are recognised in the “Investment income, net of management expenses (excluding financing costs)” aggregate - and claims handling expenses, with the latter included in the “Claims expenses” aggregate.

Total internal overheads (i.e. overheads excluding external acquisition costs (commissions)), are analysed by function, regardless of the accounting method applied to them, in all of the Group’s countries. This presentation enables a better understanding of the Group’s savings and differs on certain points from the presentation of the income statement, which meets the presentation requirements of the accounting standards.

Cost of risk

“Cost of risk” corresponds to expenses and provisions linked to covering the ceding company risk (inherent to the factoring business) and credit risk, net of credit insurance coverage.

Underwriting income

Underwriting income is an intermediate balance of the income statement which reflects the operational performance of the Group’s activities, excluding the management of business investments. It is calculated before and after recognition of the income or loss from ceded reinsurance:

- ●“Underwriting income before reinsurance” (or underwriting income gross of reinsurance) corresponds to the balance between consolidated turnover and the total sum of claims expenses, operating expenses and cost of risk;

- ●“Underwriting income after reinsurance” (or underwriting income net of reinsurance) includes, in addition to the underwriting income before reinsurance, the income or loss from ceded reinsurance, as defined below.

Income (loss) from ceded reinsurance (expenses or income net of ceded reinsurance)

“Reinsurance income” (or income and expenses net of ceded reinsurance) corresponds to the sum of income from ceded reinsurance (claims ceded to reinsurers during the financial year under the Group’s reinsurance treaties, net of the change in provisions for claims net of recourse that was also ceded, plus the reinsurance commissions paid by reinsurers to the Group for proportional reinsurance), and charges from ceded reinsurance (premiums ceded to reinsurers during the financial year for the Group’s reinsurance treaties, net of the change in provisions for premiums also ceded to reinsurers).

Investment income, net of management expenses (excluding finance costs)

“Investment income, net of management expenses (excluding financing costs)” combines the result of the Group’s investment portfolio (investment income, net gains on disposals and addition to/reversals of provisions for impairment), exchange rate differences and investment management expenses.

Operating income

“Current operating income (loss)” corresponds to the sum of “Underwriting income after reinsurance”, “Net investment income excluding financing costs” and non-current items, namely “Other operating income and expenses”.

In the presentation of operating income by region, the amounts are represented before turnover from interregional flows and holding costs not charged back to the regions have been eliminated.

Income tax expense

Tax expenses include tax payable and deferred tax that results from consolidation restatements and temporary tax differences, insofar as the tax position of the companies concerned so justifies (as more extensively described under “Accounting principles and methods” and in Note 29 to the consolidated financial statements).

Net income (Group share)

- ●“Contract acquisition costs”, consisting of:

-

3.8INVESTMENTS OUTSIDE THE INVESTMENT PORTFOLIO

Information can be found in Note 5 “Operating building and other tangible assets” of the Group’s consolidated financial statements.

1)Group estimates2)Coface Barometer: Macroeconomics put to the test by microeconomic deterioration, 17 October 2023.µµµURL: https://www.coface.com/news-economy-and-insights/country-and-sector-risk-barometer-q3-2023-macroeconomics-put-to-the-test-by-microeconomic-deterioration3)Coface Focus, Debt sustainability in Africa under the spotlight again, 12 July 2023.µµµURL: https://www.coface.com/news-economy-and-insights/debt-sustainability-in-africa-under-the-spotlight-again4)This estimated solvency ratio is a preliminary calculation made according to Coface’s interpretation of Solvency II Regulations and using the Partial Internal Model. The final calculation may differ from this preliminary calculation. The estimated solvency ratio is not audited.5)The proposed dividend is subject to the approval of the Annual General Shareholders’ Meeting of May 16, 2024.6)The estimated solvency ratio is not audited.7)This estimated solvency ratio is a preliminary calculation made according to Coface’s interpretation of Solvency II Regulations and using the Partial Internal Model. The final calculation may differ from this preliminary calculation. The estimated solvency ratio is not audited.8)Amount after capping of subordinated debt not available pursuant to Article 82 of Delegated Regulation no. 2015/35.9)Banking activity -

Financial items

4.1Consolidated financial statements

4.1.1Consolidated balance sheet

Asset

(in thousands euros)

Notes

DEC. 31, 2023

DEC. 31, 2022*

Jan. 1st, 2022*

Intangible assets

239,715

238,835

229,951

Goodwill

1

155,309

155,960

155,529

Other intangible assets

2

84,405

82,876

74,423

Financial assets

3

3,341,112

3,015,136

3,213,422

Real estate investments

3

288

288

288

Investments at amortized cost

3

143,211

102,088

87,507

Investments at FV/OCI

3

2,367,309

2,902,405

3,115,154

Investments at FV P&L

3

827,903

26

15

Derivatives and separate embedded derivatives

3

2,402

10,330

10,458

Receivables from bank and other activities

4

2,903,980

2,906,639

2,690,125

Assets - Ceded insurance contracts

15

384,810

356,217

288,647

Other assets

6

533,107

515,650

484,238

Operating building and other tangible assets

5

85,488

94,613

105,809

Deferred tax assets

17

89,899

90,693

64,078

Net clients

6

54,319

50,062

59,489

Current tax receivable

6

73,447

66,612

75,682

Other receivables

6

229,954

213,670

179,180

Cash and equivalents

7

495,558

553,786

362,441

Total Assets

7,898,282

7,586,265

7,268,824

* IFRS 17 restated, without IFRS 9 application. The wording changes in the comparative columns December 31, 2022 and January 1, 2022 are reclassifications without IFRS 9 application.

Liability

(in thousands euros)

Notes

DEC. 31, 2023

DEC. 31, 2022*

01/01/2022*

Capital and reserves - Group share

2,050,765

2,018,606

2,229,547

Capital and assimilated

8

300,360

300,360

300,360

Share capital premiums

723,501

723,501

810,420

Retained earnings

899,233

835,265

738,244

Other comprehensive income

(112,832)

(80,968)

156,708

Net income - Group share

240,500

240,446

223,817

Capital - minority interests excluding unrealized and deferred gains or losses

2,173

2,266

362

Total equity

2,052,938

2,020,871

2,229,909

Contingency reserve

11

73,942

68,662

85,748

Financial debts

13

831,743

534,280

390,553

Lease liabLities - Leasing

14

67,621

74,622

81,930

Liabilities - Issued insurance contracts

15

1,468,406

1,432,580

1,250,493

Ressources des activités du secteur bancaire

16

2,893,072

2,927,389

2,698,525

Amounts due to banking sector companies

16

762,907

743,230

822,950

Amounts due to customers ok banking sector companies

16

474,446

389,300

376,800

Debt securities

16

1,655,719

1,794,858

1,498,775

Other liabilities

18

510,560

527,861

531,666

Deferred tax liabLity

17

143,886

125,441

153,422

Current tax liabLity

18

51,917

61,681

80,712

Derivatives and related payables

18

27

222

3,480

Other payables

18

314,730

340,516

294,052

Total Liabilities

7,898,282

7,586,265

7,268,824

* IFRS 17 restated, without IFRS 9 application. The wording changes in the comparative columns December 31, 2022 and January 1, 2022 are reclassifications without IFRS 9 application.

-

4.2Notes to the consolidated financial statements

Basis of preparation

These IFRS consolidated financial statements of the Coface Group as at December 31, 2023 are established in accordance with the International Financial reporting Standards (IFRS) as published by the IASB and as adopted by the European Union (1). They are detailed in the Note “Accounting principles”.

-

4.3Parent company financial statements

4.3.1Balance sheet

Assets

(in thousands of euros)

Notes

Dec. 31, 2023

DEC. 31, 2022

Fixed assets

Intangible assets

4.1.1

-

-

Financial assets

-

-

Interests in related companies

4.1.2

1,507,584

1,502,744

Loans to affiliates and subsidiaries

4.1.3

766,991

465,466

2,274,574

1,968,211

Current assets

French government and other authorities

2,052

3,850

Group and Subsidiaries Tax

0

0

Coface current account

705,336

708,498

Miscellaneous receivables

11,805

8,391

4.1.4

719,193

720,739

Investment securities

Treasury shares

4.1.5

12,591

10,900

Cash at bank and in hand

4.1.6

919

1,243

Prepaid expenses

4.1.7

376

589

733,079

733,472

Deferred charges

4.1.8

33

230

Loan repayment premiums

4.1.9

7,959

3,681

Foreign exchange assets

3,397

6,816

Total assets

3,019,043

2,712,409

Equity and liabilities

(in thousands of euros)

Notes

Dec. 31, 2023

DEC. 31, 2022

Equity

Capital

300,360

300,360

Share capital premiums

723,517

723,517

Other reserves

31,450

31,450

Retained earning

99,527

0

Income for the year

208,001

326,480

4.2.1-4.2.2

1,362,855

1,381,806

Provisions for liabilities and charges

4.2.3

Provision for liabilities

3,397

6,816

Provision for charges

6,693

5,859

10,090

12,675

Debts

Bank borrowings and debts (1)

640,477

614,343

Other bond issues

840,354

538,770

Sundry borrowings and debts

150,198

150,201

Trade Notes and accounts payable

3,638

3,414

Other payables

5,810

0

Group and Subsidiaries Tax

1,891

4,280

4.2.4

1,642,369

1,311,008

Foreign currency translation reserve – liabilities

3,729

6,920

Total equity and liabilities

3,019,043

2,712,409

-

4.4Notes to the parent company financial statements

CONTENTS

-

4.5Five-year summary of company results

SA SDGP 41 was incorporated on March 23, 2000 and became COFACE SA (at the EGM held on July 26, 2007).

Details (in euros)

FY 2019

FY 2020

FY 2021

FY 2022

FY 2023

I – Year-end Capital

a) share capital

304,063,898

304,063,898

300,359,584

300,359,584

300,359,584

b) Number of issued shares

152,031,949

152,031,949

150,179,792

150,179,792

150,179,792

c) Number of bonds convertible into shares

-

-

-

-

-

II – Operations and income for the year

a) Revenue excluding tax

2,477,628

3,734,093

1,043,302

4,653,864

5,152,710

b) Income before tax, depreciation, amortisation and provisions

132,968,042

(17,758,389)

80,528,202

325,735,062

207,119,952

c) Income tax

(978,886)

1,179,988

1,695,116

744,811

943,577

d) Income after tax, depreciation, amortisation and provisions

132,677,046

(18,938,377)

82,223,318

326,479,873

108,001,241

e) Distributed profits

0 (1)

82,900,339 (2)

225,269,688 (3)

226,576,784 (4)

193,708,957(5)

of which interim dividends

III – Earnings per share

a) Income after tax, but before depreciation, amortisation and provisions

0.88

0.12

0.54

2.17

1.36

b) Income after tax, depreciation, amortisation and provisions

0.87

0.12

0.55

2.17

1.39

c) Dividend paid to each share

-

0.55

1.50

1.52

1.30

IV – Personnel

a) Average number of employees in the year

-

-

-

-

-

b) Payroll amount

-

-

-

-

-

c) Amount of sums paid in employee benefits

-

-

-

-

-

(1) In view of the scale of the public health crisis and following the vote at the Combined General Meeting of May 14, 2020, it was decided not to pay a dividend in respect of the financial year ending December 31, 2019

(2) For 2020, a distribution of €0.55 per share,i.e. €82,900,339 (€81,976,242 excluding treasury shares), was distributed as voted by the Annual shareholders’ Meeting of May 12, 2021.

(3) For 2021, a distribution of €1.50 per share,i.e. €225,269,688 (€224,028,658 excluding treasury shares), was distributed as voted by the Annual shareholders’ Meeting of May 17, 2022.

(4) For 2022, a distribution of €1.52 per share,i.e. €226,576,784, will be submitted to the Annual shareholders’ Meeting of May 16, 2023.

(5) For 2023, a distribution of €1.30 per share,i.e. €193,708,957, will be submitted to the Annual shareholders’ Meeting of May 13, 2024.

-

4.6Other disclosures

Pursuant to Article D.441-6 of the French Commercial Code, the table below sets out the payment terms of COFACE SA’s suppliers showing bills received and not paid at the end of the financial year for which payment is in arrears:

Suppliers’ payment terms

1 to 30 days

31 to 60 days

61 to 90 days

91 days or more

Total (1 day or more)

(A) Late payment tranches

Number of bills affected

-

1

-

-

-